Henry Rome is the deputy head of research at Eurasia Group. Follow him on Twitter at @hrome2.

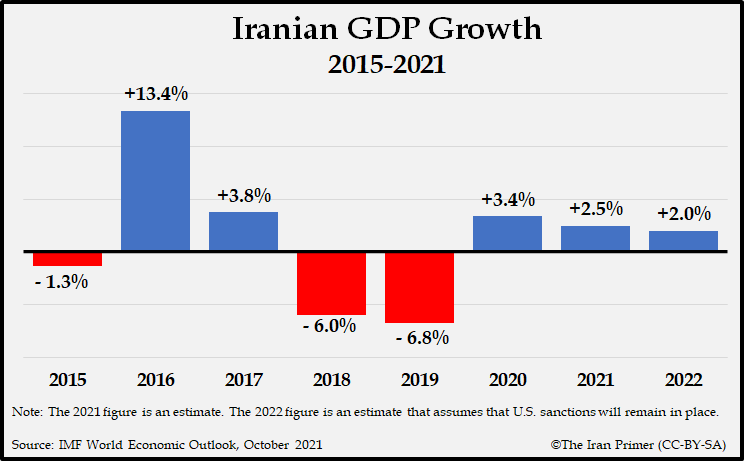

Iran’s economy expanded modestly in 2021 as trade picked up. Some of the disruptions caused by the pandemic eased as Iran vaccinated more of its population. But U.S. sanctions and uncertainty about restoring the 2015 nuclear deal led to high inflation and volatility in the value of Iran’s currency, the rial. Iran’s new president, Ebrahim Raisi, outlined more populist economic policies than his predecessor, Hassan Rouhani. But many Iranian economists were skeptical that he and his team would put the country’s economic needs ahead of ideological or political considerations.

What sanctions remain in place against Iran, and how did they affect the economy in 2021?

With very limited exceptions, the Biden administration kept in place all of the sanctions imposed as part of the Trump administration’s “maximum pressure” campaign. Washington rejected Tehran’s calls for immediate, upfront relief from sanctions. The Biden administration maintained that it would only lift sanctions as part of a return to mutual compliance with the nuclear deal, known as the Joint Comprehensive Plan of Action (JCPOA).

In 2021, the United States imposed new sanctions, including against individuals and entities allegedly involved in election interference, unmanned aerial vehicle proliferation, a kidnapping plot, oil smuggling, terrorism, and human rights abuses. But the narrow designations were not significant for the broader economy, especially compared with the weight of existing U.S. sanctions on the oil sector and other key industries.

In 2021, U.S. restrictions continued to:

- block Iran’s access to the global financial system

- force Iran to sell oil at discounted prices to a limited set of customers willing to violate the sanctions

- limit Iran’s access to foreign exchange reserves held abroad

- discourage foreign investment

- constrain trade

The primacy of the U.S. dollar and the threat of enforcement actions made it difficult for Iran to find countries and companies with which to conduct business. But sanctions were not the only cause of Iran’s economic woes. Domestic mismanagement, corruption, and the ongoing pandemic also led to another “lost year” for Iran’s economy.

The primacy of the U.S. dollar and the threat of enforcement actions made it difficult for Iran to find countries and companies with which to conduct business. But sanctions were not the only cause of Iran’s economic woes. Domestic mismanagement, corruption, and the ongoing pandemic also led to another “lost year” for Iran’s economy.

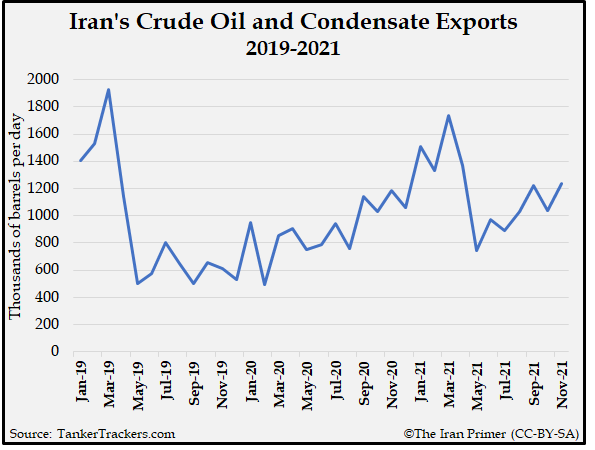

How much oil did Iran export in 2021? How did that compare to its initial expectations?

Iran’s goal was to export 2.3 million barrels per day of crude oil and condensate at an average price of $40 per barrel, for the Iranian year that started in March 2021. The price estimate was quite conservative—the Brent oil price, a global benchmark, has averaged $73 per barrel since March—but the volume target was off by a wide margin. The subsequent revenue shortfall contributed to a large budget deficit and high inflation.

Iran did not release oil export data, but TankerTrackers.com, which monitors Iranian transfers via satellite imagery, estimated that Tehran has sold approximately 1.2 million barrels per day on average of crude oil and condensate. China was the buyer of the majority of these barrels.

Iran did not release oil export data, but TankerTrackers.com, which monitors Iranian transfers via satellite imagery, estimated that Tehran has sold approximately 1.2 million barrels per day on average of crude oil and condensate. China was the buyer of the majority of these barrels.

Those sales, however, did not necessarily yield much revenue for Iran. Government records indicated that it only received a tiny portion of the dollar value of the exports, even assuming that Iran sold oil at a steep discount. For example, in the second quarter of 2021, Iran’s crude oil and condensate exports were worth more than $6 billion at Brent prices. But the government reported less than $100 million of oil revenue during this period. The large disparity has not been explained. Intermediaries or other entities within the Iranian state may have taken a large share of the revenues, or it could remain frozen in overseas banks due to U.S. sanctions.

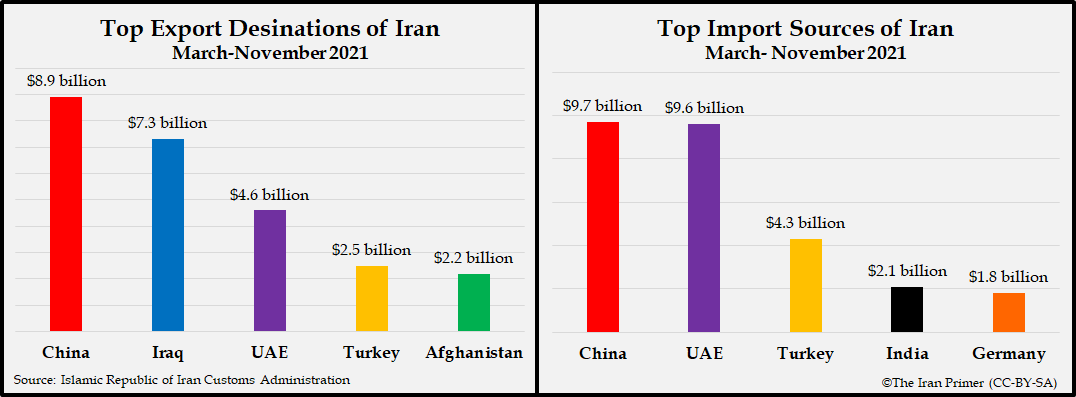

How much non-oil trade did Iran conduct in 2021? What were its top trade partners?

Iran’s non-oil trade sharply increased in 2021 compared to the previous year, as the economic disruptions caused by the pandemic started to dissipate. From March to November 2021, total non-oil trade was $63.1 billion, a 41 percent increase over the same period in 2020, and 14 percent higher than the pre-pandemic year of 2019.

In 2021, Iran’s top non-oil trade partner was China, followed by the United Arab Emirates, Turkey, and Iraq. If Iranian trade continues at the monthly average for 2021, it will notch more than $90 billion in imports and exports for the Iranian year ending in March 2022. This would be the highest level since 2017/18.

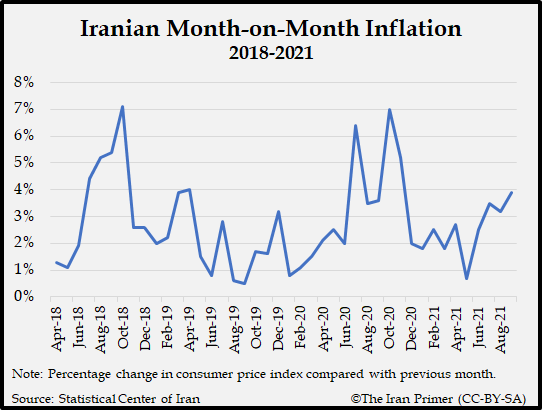

What was inflation in 2021? How did prices for everyday goods change?

Consumer prices rose sharply compared to 2020. “Unprecedented and chronic inflation and a decrease in per-capita income created a large gap between households’ income and expenditures,” Raisi’s choice to head the Ministry of Economic Affairs and Finance, Ehsan Khandoozi, told Parliament during his confirmation hearing in August. This gap “created difficulties in the daily livelihoods for middle- and low-income levels.”

In November, the government said that overall inflation over the prior 12 months was 44.4 percent. Food and beverage prices rose particularly high, with inflation at 59.6 percent. Goods that faced the highest level of inflation included: fish (66.8 percent); tea, coffee, and other beverages (66.8 percent); and vegetables (60.9 percent).

In November, the government said that overall inflation over the prior 12 months was 44.4 percent. Food and beverage prices rose particularly high, with inflation at 59.6 percent. Goods that faced the highest level of inflation included: fish (66.8 percent); tea, coffee, and other beverages (66.8 percent); and vegetables (60.9 percent).

Inflation remained persistently high in part due to the large gap between state income and expenditures. Low oil revenues and disappointing bond sales forced the government to borrow directly or indirectly from the central bank to pay its bills, including salaries of government employees and welfare payments. The resulting increase in the money supply helped fuel inflation.

Inflation ticked down slightly toward the end of 2021. Several factors may have contributed to the trend, including rising oil prices, changes in government borrowing patterns, and a return to nuclear negotiations.

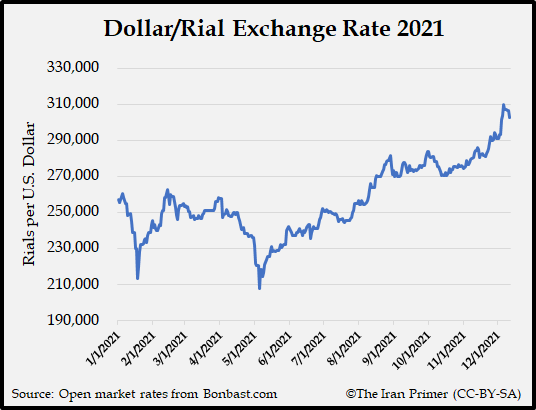

What happened to the value of Iran’s currency in 2021?

Political developments had a powerful impact on market sentiment. The Iranian rial appreciated against the dollar after the United States announced its willingness to negotiate a mutual return to compliance with the 2015 nuclear deal. The rial kept strengthening as Iran and the world’s major powers – Britain, China, France, Germany, Russia, and the United States – appeared to make progress in six rounds of talks from April to June.

But market sentiment shifted in the runup to the June presidential election as Raisi, a hardliner, emerged as the leading candidate. During the campaign, he espoused a more confrontational attitude towards the West. Between the end of May – when Raisi’s main competitors were disqualified, all but assuring his victory – and when Raisi’s government took office in August, the rial fell nine percent against the dollar. The rial tumbled a further 15 percent between Raisi’s inauguration and mid-December.

But market sentiment shifted in the runup to the June presidential election as Raisi, a hardliner, emerged as the leading candidate. During the campaign, he espoused a more confrontational attitude towards the West. Between the end of May – when Raisi’s main competitors were disqualified, all but assuring his victory – and when Raisi’s government took office in August, the rial fell nine percent against the dollar. The rial tumbled a further 15 percent between Raisi’s inauguration and mid-December.

The new government tried to stem the fall in the rial by periodically alluding to the unfreezing of foreign reserves held abroad. But the announcements only had transient impacts on the strength of the rial, as Tehran provided no evidence that assets were actually freed from U.S. sanctions.

How has the new Raisi government approached the economy? How does it contrast with the Rouhani government?

Raisi and Rouhani differed in their approaches in two key ways. First, Rouhani viewed the restoration of the nuclear deal as the most effective way to ease the effects of U.S. sanctions. He saw the JCPOA as a gateway to European trade and investment.

Raisi, echoing Supreme Leader Ayatollah Ali Khamenei, has argued that while Iran should try to get sanctions lifted through negotiations, it should also focus on neutralizing their effects. Raisi and his “revolutionary” allies, in a critique of Rouhani, have pledged to not link the fate of the economy to the JCPOA and sanctions relief. “We will certainly be after lifting cruel sanctions, but we will certainly not make the people’s livelihoods and the economy conditioned, and won’t tie it to the will of foreigners,” Raisi said upon taking office.

In line with the “resistance economy” model, Raisi has focused on building domestic capabilities and increasing trade with regional states, China, and Russia. His first trip abroad was to the summit of the Shanghai Cooperation Organization in Dushanbe, Tajikistan on September 16-17. At the summit, the economic and security bloc began the process to formally admit Iran as a full member. Raisi is expected to oppose an expanded role for the private sector or international players, unlike Rouhani, who attempted to open up key sectors such as oil and gas following the nuclear deal. Raisi may also oppose reforms to Iran’s banking sector, which falls far short of global standards for countering money laundering and terrorism financing. North Korea is the only other country considered “high risk” by the Financial Action Task Force, a global financial watchdog.

Second, Raisi has a populist streak and appears to be much more attuned to the lower classes of society. Raisi’s weekly trips to the provinces to meet and reassure average Iranians called to mind Mahmoud Ahmadinejad, who was president from 2005 to 2013. Raisi has vowed to better support lower classes amid the current economic turmoil. This contrasted with Rouhani, who let the Ahmadinejad-era cash transfer program erode as inflation rose. Raisi’s frequent rhetoric about “justice” in economic planning reflects his judicial background and a popular desire to tackle corruption and mismanagement.

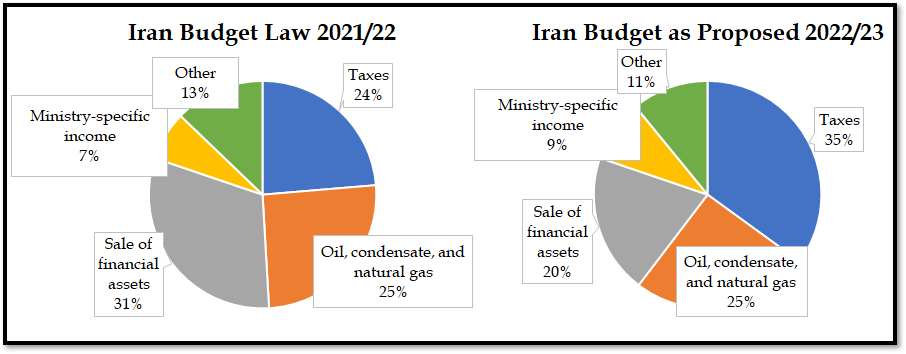

On December 12, Raisi presented a draft budget for 2022-23 to parliament. What did it include and how did it compare to the 2021-22 budget?

Raisi’s first budget was the opposite of Rouhani’s final budget. Instead of betting on sanctions relief, Raisi planned for a continuation of U.S. sanctions and set modest targets for oil exports. Government spending was set to increase by nine percent, but considering that annual inflation hovered around 40 percent in December, the government actually cut expenditures in real terms.

While the budget was less reliant on bond sales, it assumed an increase in tax revenue—based in part on the expectation of eight percent GDP growth in 2022. That was very optimistic, considering the International Monetary Fund estimated GDP growth to be around two percent.

What will be the biggest economic challenges facing Iran in 2022?

The fate of the 2015 nuclear deal will be the key determinant of the Iranian economy in 2022. If the world’s major powers and Iran revive the agreement, the economic benefits could be significant. Sanctions relief would not solve all of Iran’s economic ills, but it would give Raisi a substantial buffer to address other issues, such as environmental degradation or a potential new wave of coronavirus cases owing to the Omicron variant.

A collapse of negotiations would pose a significant challenge for the government. It would need to find a way to generate growth, rein in inflation, and create jobs while grappling with an indefinite economic handicap. The government would lean into its resistance economy ideology to remain afloat. But the sustainability of this strategy is questionable. A deteriorating economy risks more street protests and instability.