Since the 2015 nuclear agreement, Iran has signed deals worth tens of billions of dollars—on oil, aviation, solar energy, health care, and consumer goods—with companies on four continents, including North America and Europe. Foreign companies have coveted the Iranian market since sanctions were lifted in January 2016. But they faced increasing uncertainty after the Trump administration reversed policy on the Joint Comprehensive Plan of Action (JCPOA) in 2017. He announced that Iran had violated the “spirit” of the accord—and refused to certify Tehran’s compliance to Congress. Economic development in Iran since the nuclear agreement has manifested in some high-value deals and ambitious projects. However, Tehran is unsatisfied with the economic benefits it is receiving from the deal and wants greater economic engagement with Western countries.

#IranDeal obliges US to support successful implementation, incl in public statements, and to refrain from adversely affecting normal trade. pic.twitter.com/l65taPdjnL

— Javad Zarif (@JZarif) April 20, 2017

Iran’s economy has experienced robust oil-driven recovery since sanctions were lifted but is still slow to grow in non-oil sectors. In 2016, the Islamic Republic’s economy grew by 13.4 percent, a strong improvement from 2015, when the economy contracted by 1.3 percent, according to the World Bank. The International Monetary fund has projected a more modest GDP growth rate of 3.5 percent for 2017. Oil has been the anchor of Iran’s recent recovery. The Islamic Republic increased its oil and gas production by a striking 62 percent in 2016, primarily due to sanctions relief, while non-oil GDP grew by just 3.3 percent. Although Iran’s non-oil sector continues to lag, 3.3 percent is the highest growth rate it has experienced in 5 years.

Trickle of foreign investment into Iran's oil industry could turn into a flood over the next 5 years https://t.co/qYw3JRYmG5 pic.twitter.com/S5dskKpyss

— CNN (@CNN) July 11, 2017

Prospects for growth outside of Iran’s oil sector depend heavily upon foreign investment. But the JCPOA has not produced the flood of foreign investment that Tehran anticipated. “On the demand side, all components except investment registered improvements over the previous year,” according to an October 2017 World Bank report. The investment climate seems to be improving though. Investment contracted by just 3.7 percent in 2016 compared to 12 percent in 2015. The World Bank attributes the reduction in investment to Iran’s shrinking construction sector. A surge in speculative demand for housing in 2012 caused Iran’s construction sector to contract, driving investment down.

Facilitating foreign investment is a high priority for Iranian officials. The Islamic Republic’s most recent Five-Year Development Plan says that Iran needs to attract at least $50 billion of foreign investment each year—through either direct, finance, or joint investment-- in order to meet its goal of 8 percent economic growth. In 2016, the country acquired only $3.37 billion in foreign direct investment.

A key barometer of the nuclear deal’s longevity will be the economic benefits from curtailing its nuclear program. Iran has blamed the United States for lackluster foreign investment. “On paper the United States allows foreign banks to deal with Iran, but in practice they create Iranophobia so no one does business with Iran,” Supreme Leader Ayatollah Ali Khamenei said in April 2016, four months after sanctions were lifted.

The situation did not improve after Trump took office, according to Iranian officials. The new administration is “trying to make it impossible for Iran to benefit from the deal,” Foreign Minister Mohammad Javad Zarif said in July 2017. He also claimed that President Trump “used his presence in Hamburg during the G20 meeting in order to dissuade leaders from other countries to engage in business with Iran.”

Investing in Iran also comes with unique risks. U.S. and European sanctions for human rights abuses and support for extremist groups remain in place. The targets of sanctions are often connected to the Islamic Revolutionary Guard Corps (IRGC), Iran’s most powerful security and military organization. The problem is that the IRGC is also a powerful economic actor involved in many sectors of business and industry. Companies need to employ robust due diligence practices to avoid violating sanctions, which can cost billions of dollars and damage their reputations. With so many structural obstacles and risks, many investors are hesitant to enter the Iranian market. “The choice is easy between huge interests in the US compared to complicated and risky ones in Iran,” a German banker said in March 2017.

Excellent meetings with leaders in Berlin, Rome & Paris. Despite US reckless hostility, EU committed to #JCPOA & constructive engagement.

— Javad Zarif (@JZarif) June 30, 2017

The Financial Action Task Force (FATF), the global standard setting body for anti-money laundering and combatting terrorism financing, still has concerns about Iran. The government has taken steps to clean up its financial sector, but not enough for the FATF. “Until Iran implements the measures required to address the deficiencies identified in the Action Plan, the FATF will remain concerned with the terrorist financing risk emanating from Iran and the threat this poses to the international financial system,” the body said on November 3, 2017. E.U. foreign policy chief Federica Mogherini has also acknowledged the challenges of investing in Iran. “Progress in the financial and banking sector has been slower due to a number of factors. But important work is being carried out to improve the situation - also including on the Iranian side,” she said on Dec. 12, 2017.

Iran’s business climate, riddled with corruption, also presents challenges to investors. The World Bank ranks countries’ economies on their ease of doing business based on the procedures needed to start a business, get construction permits, register property, access credit, enforce contracts, trade across borders, etc. Iran ranked 124 out of 190 countries in the 2018 “Doing Business” report. “Despite recent improvements in the business environment, Iran needs to reduce red tape, reform state-owned enterprises and improve transparency about corporate beneficial ownership to attract investment and develop the private sector,” the International Monetary Fund said in December 2017.

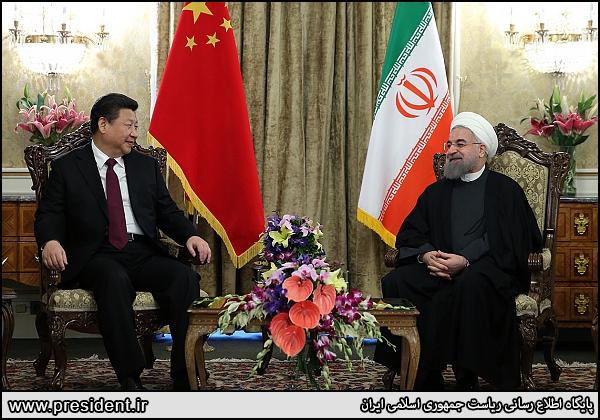

Iran’s hope for the future depends on the deal’s other five signatories—Britain, China, France, Germany and Russia. All have vowed to continue engagement with Iran, diplomatically and economically. They remain committed to U.N. Security Council Resolution 2231, which unanimously endorsed the Iran nuclear deal. For the first time since the 1979 revolution, Europe and the United States are taking opposite positions. European countries are standing strong in their support for the JCPOA and actively campaigning to preserve it.

After Trump announced that he would not recertify Iran’s compliance with the deal, France, Germany and the United Kingdom were quick to issue a joint statement encouraging the United States to “consider the implications to the security of the U.S. and its allies before taking any steps that might undermine the JCPOA.” Prime Minister Theresa May has affirmed Britain’s support for the deal, calling it “vitally important for regional security.” In November 2017, she said that “We must stand firm in our support for the ....deal.”

Who’s Doing Deals

By October 2017, Iran had acquired about $14 billion in foreign direct investment through deals worth up to $10 billion with Austrian, French, Danish, Chinese and Korean banks. It is keen to expand its energy sector. New projects are underway in the South Pars Oil Fields and the Islamic Republic has signed contracts to build solar energy plants that total over $7 billion. In October, Deputy Oil Minister for International Affairs Amir Hossein Zamaninia said that the country expects to secure $20 billion in energy contracts over the next year.

Foreign direct investment, though slow to return, increased from $2.05 billion in 2015 to $3.37 billion in 2016, a 64 percent rise, according to a U.N. Conference and Trade Development report. So far, China has demonstrated the greatest intent to invest in Iran of any country. China’s state-owned CITIC Group has extended a credit line worth $10 billion to Iran while The China Development Bank signed a memorandum of understanding (MOU) for $15 billion in loans.

Many major European companies, perhaps reassured by the efforts of their respective governments to defend the nuclear deal, have expressed interest in the Islamic Republic’s business opportunities. To date, European companies have taken advantage of opening Iranian markets far ahead of their American counterparts. Europeans have secured contracts valued at up to $5 billion in oil, transportation, solar energy, aviation and other sectors. By contrast, American commercial engagement with Iran has produced just a handful of high-value deals in the aviation sector. Enhancing business ties with Europe has aided the Iranian economy’s recovery. In December 2017, Federica Mogherini stated that:

Trade between Iran and Europe increased 94 percent in the first half of 2017, compared to the first half of 2016. Oil exports have reached pre-sanctions level, and billions of outstanding oil debts have been paid back. Foreign Direct Investment is increasing, and the Iranian government reported a growth of 55 percent compared to the previous year.

Banking

So far, European banks have approached investment opportunities in Iran cautiously. The Islamic Republic did not secure financing from major Austrian, Danish and French banks until September 2017. European banks fear they could violate remaining U.S. sanctions inadvertently and incur heavy penalties. For example, in 2015, French bank BNP Paribas was ordered to pay $9 billion in penalties for violating U.S. sanctions against Iran, Cuba and Sudan.

In 2017, however, Iran and companies interested in doing business there managed to secure credit from a variety of institutions and countries.

- The China Development Bank is considering establishing a $15 billion credit line with Iran (November 2017)

- Iran established a $10 billion credit line with China’s CITIC Group to finance infrastructure projects in areas including water, energy and transportation (September 2017)

- Denmark’s Danske Bank will provide a line of credit worth about $598 million to 10 Iranian banks (September 2017)

- BPI France, a French state-owned bank, will supply a $598 million credit line to French companies who want to invest in Iran (September 2017)

- Oberbank will provide $1 billion worth of credit to finance Austrian projects in Iran lasting over two years in areas that were previously off limits due to sanctions (September 2017)

- South Korea agreed to provide a $13 billion line of credit to support Iranian projects. South Korea’s Export-Import Bank (KEXIM) will supply $9.4 billion credit line to finance projects including a refinery in Isfahan and eight gas condensate refineries in Asalouyeh while the Korea Trade Insurance Corporation (K-SURE) will provide the rest (August 2017)

- The China Development Bank signed a cooperation agreement with Iran’s Tejarat Bank to provide a $300 million loan to finance Iranian projects for the Telecommunications Company of Iran (May 2017)

- Japan signed an MOU with Iran in 2016 to establish a $10 billion line of credit for financing projects in Iran (February 2016)

China provides $10 billion credit line to Iran https://t.co/xGtHZwAYnE pic.twitter.com/NPCGmhKMHf

— Hindustan Times (@htTweets) September 16, 2017

Oil and Gas

Iran hopes to attract investment for ventures aimed at exploring and developing dozens of oil and gas fields. Projects in this sector have focused on the South Pars Gas Field, the world’s largest gas field, which is shared between Iran and Qatar. Phase 12 of the South Pars Gas Field contains an estimated 14 trillion cubic meters of gas, making it the hub of activity for oil and gas projects.

French energy giant @Total signs a groundbreaking deal with #Iran to develop Ph11 of South Pars Gas Field. Details: https://t.co/1CFjOQ3zNz pic.twitter.com/4raS0cnjUw

— Financial Tribune (@Fintribune) July 3, 2017

By late 2017, Iran had made just a handful of high-profile deals, the most valuable being a $5 billion contract France’s Total. Development in oil and gas has primarily taken the form of MOUs inked between Iran and European countries over finalized contracts. Projects in the South Pars Gas Field are explorative in nature, which may explain why investors are risk averse.

- Iran’s MAPNA, a company involved in power, oil and infrastructure, signed an initial agreement with General Electric for cooperation on power, oil and infrastructure projects. MAPNA’s CEO said talks were underway to finalize a deal. (November 2017)

- Iran signed an MOU with Norway’s Offshore Resource Group to study the development of Sardar-e Jangal oil and gas field and the offshore exploratory blocks 24, 26 and 29 (November 2017)

- Iran’s North Drilling Company, a subsidiary of the National Iranian Oil Company, signed an MOU with France’s Altea Resources for cooperation in drilling-related operations and services (November 2017)

- Italian firm Ansaldo Energia signed an MOU with Iran worth an undisclosed amount for the collection of petroleum gas being burned off in the South Pars Gas Field Phase 12 (October 2017)

- France’s SOFREGAZ S.A. signed a deal with the National Iranian Oil Company worth $42 million to collect and reuse natural gas being burned off in the South Pars Gas Field (September 2017)

- Iran’s Tabriz Oil Refining Company signed a deal with South Korea’s SK Engineering & Construction valued at $1.6 billion to upgrade the company’s refinery facility (August 2017)

- General Electric’s non-U.S. affiliates reached agreements to sell equipment and technology to Iran’s energy sector for $20 million (July 2017)

- Italian oil company Eni signed an MOU with the National Iranian Oil Company to study the Kish gas field and the third phase of southern Iran’s Darkhovin oil field and collect outstanding payments worth $280 million on previous investments (July 2017)

- French energy company Total secured a contract worth $5 billion to finance and develop a gas venture in the South Pars Gas Field with Iranian and Chinese firms (July 2017)

- Two Iranian oil companies, the National Iranian Oil Company and Petropars, signed an agreement with Japan’s Toyo Engineering Corporation to develop the Persian Gulf’s offshore Salman oil and gas field (July 2017)

- Iran signed a preliminary agreement worth $3 billion with a South Korean-Japanese consortium to develop Siraf Refining Park (July 2017)

- Iran signed an agreement worth $3.2 billion with South Korea’s Hyundai Engineering Co. to finance and construct the second phase of Kangan Petro Refining Complex — a major petrochemical and refinery project in Iran’s southern Bushehr province (March 2017)

- Royal Dutch Shell Company signed an MOU with Iran to evaluate three of Iran’s largest oil and gas fields (December 2016)

- Germany’s Siemens signed a contract of unknown value with Iran’s MAPNA group for delivery of more than 20 Siemens F-class gas turbines throughout the next decade (March 2016)

Aviation

Aviation deals have been a crucial and highly anticipated benefit of the JCPOA for the Islamic Republic. Sanctions have prevented Iranian airlines from replacing their outdated and accident-prone fleets for decades. Before the nuclear deal, the country’s 17 airlines had about 150 planes in regular service and another 100 planes grounded for repairs or to be stripped for parts.

The aviation sector has seen the most American engagement so far, with Boeing securing deals totaling approximately $20 billion. Iranian airlines have made agreements to purchase up to 140 planes from Boeing and 100 from Airbus. The first Boeing aircraft is expected to be delivered in April 2018.

Some U.S. lawmakers, however, are concerned that the aircrafts could transport weapons or troops across the region to participate in activities that threaten U.S. interests. In April 2017, Senator Marco Rubio (R-FL) and Representative Peter Roskam (R-IL) urged President Trump to suspend the Boeing sales in an open letter:

Iran, the world’s leading state sponsor of terrorism, has systematically used commercial aircraft for illicit military purposes, including to transport troops, weapons, and cash to rogue regimes and terrorist groups around the world. The possibility that U.S.-manufactured aircraft could be used as tools of terror is absolutely unacceptable and should not be condoned by the U.S. Government.

The Trump administration’s focus on countering Iran’s activities in the region has called the deal into question as well. The Iranians “were going to buy Boeings. I don't know what's going to happen with the deal. We'll see what happens with the deal,” Trump said cryptically in an interview on October 22, 2017.

As of mid-December 2017, Trump’s team had not yet been presented with options for dealing with the aircraft sales. But U.S. officials and others familiar with the issue told The Wall Street Journal that the options included banning sales, imposing strict conditions that could halt deliveries and slow-walking approvals.

Eric Lorber, a senior advisor to the U.S. Treasury’s Undersecretary for Terrorism and Financial Intelligence, had proposed another arrangement before he joined the administration. At a public event, he said that Iran could be required to fund the sales via an escrow account and agree on a timetable with the United States for gradual delivery of planes. Then the United States could cut off sales and perhaps confiscate the funds held in escrow if it found evidence of Iran Air using the planes for non-commercial purposes.

New #ATR72 aircraft have made it possible for #IranAir to add new destinations -- and more airplanes will be delivered soon. #Homa pic.twitter.com/RYu5sJvgK1

— Iran Air (@IranAir_IRI) December 7, 2017

Iran has also purchased planes from Europe’s Airbus and Franco-Italian aircraft manufacturer ATR. The Islamic Republic’s national airline Iran Air ordered 100 new commercial aircrafts from Airbus. The order included 46 A320 planes, 38 A330 planes, and 16 A350 planes. Airbus delivered the first aircraft from this order—an A321— in January 2017 and two more A330s in March 2017. Iran Air has also signed a contract with ATR for 20 ATR 72-600 aircrafts, and as of December 2017 has received six planes from that order. The remaining 14 aircrafts are scheduled to be delivered before the end of 2018.

- Boeing and Iran Aseman reached a deal for the sale of 30 Boeing 737s for $3 billion (June 2017)

- Two privately owned Iranian Airlines, Zagros Airlines and Iran AirTour signed MOUs with Airbus to purchase 73 planes worth approximately $2.5 billion (June 2017)

- Iran’s Qeshm Airline signed a preliminary agreement with Boeing to purchase 10 B737Max passenger jets (June 2017)

- France’s Vinci SA construction company signed a contract with Iran’s Kayson Inc. worth an estimated $404 million to invest in the development of two Iranian airports (April 2017)

- U.S. manufacturer Boeing signed a $16.6 billion deal with Iran Air for the sale of 80 commercial aircrafts, the first of which is expected to be delivered in April 2018 (December 2016)

- Franco-Italian aircraft manufacturer ATR reached a deal with IranAir worth $1.2 billion for the sale of 20 aircrafts (ATR 72-600) (February 2016)

- The European aircraft manufacturer Airbus announced that it will sell 100 commercial aircrafts to Iran Air for about $10 billion (January 2016)

Automobiles

The automobile industry, historically the biggest after oil and gas, is a key driver of Iran’s economy. Iran’s market is inviting to automobile manufacturers. There is only one car for every 100 people in the Islamic Republic—a figure six times higher in the European Union.

Activity in this sector post-JCPOA has been dominated by French and German manufacturers, some of whom are reentering Iran’s market. French car maker PSA used to be a major competitor, but it suspended sales in the Islamic Republic in 2012 because of sanctions. Another French automobile manufacture, Renault, also had active operations in Iran up until 2013, when it was forced to abandon its activities due to the imposition of stricter sanctions laws.

In 2017, Renault signed a deal to increase its production in the Islamic Republic to 350,000 automobiles. Renault and PSA do not have manufacturing or sales operations in the United States, which makes them less susceptible to being punished for violating remaining U.S. sanctions that ban financial transactions with Iran.

- Switzerland’s Atoneum reached a license agreement with Iranian automotive supplier Ayegh Khodro Toos (AKT) to produce and distribute components including carpet systems and inner dashes (December 2017)

- Germany’s Mercedes Benz Trucks signed a deal of undisclosed value with Iran Khodro, an Iranian auto company, to establish a joint venture (September 2017)

- Renault also formed a joint venture with the Industrial Development & Renovation Organization of Iran and Parto Negin Naseh to help increase its production capacity (August 2017)

- Germany’s Volkswagen reached a deal with Iranian car manufacturer Mammut Khodro for the sale of two car models (July 2017)

- French PSA, which makes Peugeots and Citroens, signed $768 million worth of deals with SAIPA and Iran Khodro (May 2017)

- France’s Renault, which has been in Iran since 2012, announced that it will increase production to 350,000 vehicles (May 2017)

- Germany’s Siemens signed an MOU with Tam Co., a subsidiary of Iran Khodro, to develop joint products and facilitate future production (May 2017)

- Italy’s Pininfarina signed a deal with Iran Khodro Group worth approximately $76.3 million to develop a technological automotive platform (May 2017)

- Iran’s Kerman Motors signed an agreement with South Korea’s Hyundai Motors to begin production of the Elantra model in the firm’s southern production facility (March 2017)

Iran Khodro, the largest car maker in Iran, says it will start test production of #Peugeot 301 in the coming week pic.twitter.com/bNOv3pTlTl

— Financial Tribune (@Fintribune) November 14, 2017

Transportation

Iran is ramping up construction on its railroad system through projects worth tens of billions of dollars on many of its cross-country routes. The Islamic Republic currently possesses a network of railroads that stretch some 6,200 miles throughout the country. It wants to expand this network to 15,500 miles. About 4,700 miles of the proposed expansion are currently under construction. So far, much financing for these projects has come from Chinese, Japanese and Russian companies, but Germany’s Siemen’s AG has secured a contract valued at around $2 billion. As Iran seeks to capitalize on its potential for becoming a transportation hub, it is embarking on numerous ventures. European companies have appeared to be more risk averse than their Asian counterparts.

- Iran signed a deal with Russia to finance $3.5 billion on rail transportation equipment and joint manufacturing 20,000 freight cars, 1,000 passenger cars and 350 locomotives (December 2017)

- South Korea’s Hyundai Rotem signed a contract valued at about $856 million to build 450 suburban railbus wagons (December 2017)

- Iran signed a contract with the Dutch Damen Shipyard Group to construct an offshore floats manufacturing facility in Iran’s southern Khorramshahr city (November 2017)

- Iran secured $3.5 billion and $10 billion in finance from German and Japanese companies, respectively, to be used for railroad projects (October 2017)

- Iran signed a deal worth $1.37 billion with Italy’s state rail company Ferrovie dello Stato to construct a high-speed railroad stretching from the cities of Qom to Arak (July 2017)

- Iran signed an agreement with China’s Exim bank in July 2017 to finance $1.5 billion for the electrification of the main rail line between Tehran and Mashhad (July 2017)

- Iran reached an agreement with China National Machinery Import and Export Corporation (CMC) worth about $2.4 billion to help construct a railway stretching from Tehran to Mashhad (May 2017)

- Iran struck a preliminary deal with state-owned Russian Railways for about $1.4 billion to electrify the Garmsar-Inche Borun railroad (August 2016)

- Germany’s Siemen’s AG signed a contract with Iran thought to be worth approximately $1.6 billion to construct rail coaches and upgrade train lines in Iran (January 2016)

Solar Energy/Environment

Iran has been rapidly developing its solar energy sector through a wave of deals with European energy companies worth up to $2.94 billion. Solar energy is an important area of growth for the country. Heavy usage of fossil fuels has contributed to severe pollution, so the government is eager to encourage the growth of alternative forms of energy.

In 2016, the World Health Organization identified Zabol, a city in Iran’s eastern Sistan and Baluchestan province, as the most polluted city in the world. In August 2017, an official from Iran’s Environmental Protection Organization warned that air pollution kills 35,000 people in the country each year. Iranian officials closed schools in Tehran and other major cities in December 2017 due to dangerously high levels of air pollution.

🇮🇷 Heavy air pollution shuts schools in Iran 📷 Atta Kenare #AFP pic.twitter.com/AbToP2pMBd

— AFP Photo (@AFPphoto) December 17, 2017

With an average of 2,800 hours of sunshine per year and an ambitious plan to cut carbon emissions by 4 percent by the year 2030, Iran is an enticing market for solar energy companies.

- Iran signed a total of 22 MOUs with private South Korean companies for transfer of technology to Iran in the fields of thermal insulation, solar panels, alternative energy, lithium batteries and electric engines (December 2017)

- Iran signed MOUs of unknown value with Denmark’s Iran Ensheab Co., Tara Engineering Co., and Energy Development Co. for cooperation on water management projects including construction of sewage cleaners and sewage treatment plants and the construction of smart water meters (November 2017)

- Iran’s Industrial Development and Renovation Organization signed an MOU with China’s Znshine PV-Tech Company to attract foreign finance for construction of a 200-megawatt solar plant, worth an estimated $23.5 million (October 2017)

- Iran signed a preliminary agreement with Norwegian solar company Saga Energy for $2.94 billion to build two gigawatts of solar power plants on various sites

- Iran’s Fars Province Investment Services Center signed an MOU with Austrian Benefit & Solar Company to construct four solar power plants worth $100 million in Abadeh County (October 2017)

- Iran signed a $115 million contract with Britain’s Global Green Company to invest in garbage recycling projects in Zanjan, a northwestern province (October 2017)

- Norway’s Scatec Solar has been in talks with Iran to construct the company’s first solar plant in the country, valued at $132 million, which would generate 120, and eventually 500 megawatts of power (September 2017)

- British renewable energy investment firm Quercus announced a plan to invest over $700 million in the construction of a 600-megawatt solar photovoltaic plant in central Iran (September 2017)

- Nine South Korean companies signed 10 MOUs with 40 small and medium-sized Iranian companies for cooperation on transfer of technology in fields including spare parts, fishery, marine environment, apiculture, biologic fertilizer, die casting, oil, and gas (July 2017)

Health

Iran’s healthcare industry has the potential for massive growth. The government has forecasted a $17 billion investment requirement in the next five years to meet midterm demand, in part because of underinvestment during the years Iran faced sanctions. One of the country’s biggest challenges will be to provide affordable care to a rapidly aging population. By 2030, some 28 percent of the population will be over age 50.

Quality healthcare has made Iran a popular destination for the lucrative industry of medical tourism. Iran has been dependent on European imports of medical devices, but Western investment in the healthcare industry has been slow coming.

- South Korea’s Health Insurance Review Agency signed an MOU with Iran’s Health Insurance Organization for mutual cooperation in Iran’s health sector including activities such as exchanging information and experience in insurance activities, evaluating the quality of services and monitoring drug intake (December 2017)

- American medical device manufacturer Second Sight entered the Iranian market (December 2017)

- Iran’s Ministry of Health signed an MOU with the International Hospitals Group for a $2.1 billion investment in the construction of modern cancer treatment centers across the country (October 2017)

- Six South Korean firms including Samsung C&T Corp. and Hyundai Engineering & Construction Co. have signed seven MOUs expected to be worth approximately $2 billion with Iranian Medical Schools to construct seven medical centers in Tehran which have a total of 6,000 beds (May 2016)

- Austria’s VAMED company signed an agreement with Iran’s Social Security Organization to build two 320-bed hospitals in Shiraz (April 2016)

Commercial Goods

Iran is a country with a strong consumer culture. Its large, young population is tech-savvy, sophisticated and hungry for Western goods. Despite a promising market for Western products, Iran’s commercial sector has not seen as much engagement as other industrial sectors like oil and transportation. This may be due in part to remaining barriers that limit business activity with the Islamic Republic.

President Trump modified sanctions remaining on Iran after the nuclear deal and implemented new sanctions in August 2017, primarily aimed at its ballistic missile program. The administration has not made it clear yet if the restrictions are meant to apply to technology companies, so some businesses are erring on the side of caution.

Apple has no official presence in Iran, but millions of its products have been smuggled into the Islamic Republic. It accounts for 11 percent of the mobile phone market, according to Telecommunication Minister Mohammad Javad Azari Jahromi. But instead of taking steps to officially enter the market, Apple removed Iranian apps from its App Store in August 2017. The move appeared to be an effort to avoid running afoul of sanctions. “Under the U.S. sanctions regulations, the app store cannot host, distribute or do business with apps or developers connected to certain U.S. embargoed countries,” Apple wrote in a message to Iranian app developers.

A week later, Google also removed Iranian apps from its Google Play store and terminated the accounts of some Iranians using its Google Analytics service. For years, Iranian developers had gotten around restrictions by offering apps to locals through App stores outside of Iran.

- Anglo-Dutch company Unilever signed a joint-venture partnership with Iran’s Golestan Company to locally manufacture and sell new brands and lines of food products in Iran (November 2017)

- Spain’s Telepizza opened its first of seven Iranian restaurants in Tehran and signed a franchise agreement with Iran’s Momenin Investment Group that will have MIG invest $114 million in the next 10 years (July 2017)

Emily Salwen was a research assistant at the Woodrow Wilson International Center for Scholars.