Virtually every aspect of Iran’s economy has been impacted by the global pandemic. In the year since the first case of COVID-19 in February 2020, Iran’s economy has faced new challenges exacerbated by longstanding problems, including years of punitive U.S. sanctions. The main consequences have been:

- Economic recession: Gross domestic product (GDP) shrunk by five percent in 2020.

- Higher unemployment: More than one million people – in a labor force of 27 million – lost their jobs in 2020.

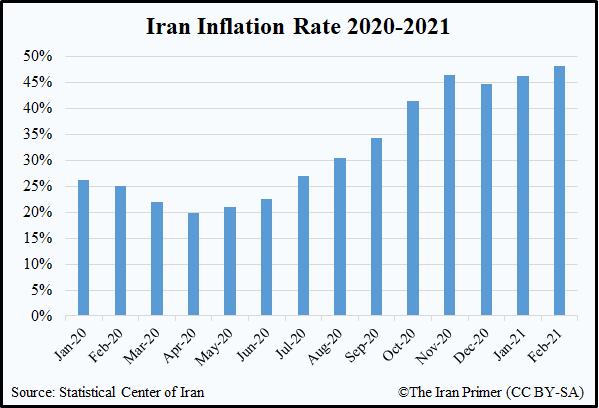

- Higher inflation: Inflation in February 2021 was at 48 percent, nearly double what it had been in February 2020.

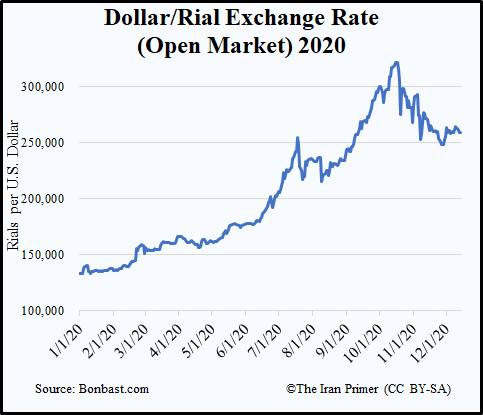

- Devalued currency: The rial lost more than half of its value against the dollar in 2020.

The following graphs illustrate how Iran’s economy has weathered the pandemic.

Related Material:

- One Year of COVID: Politics of Vaccination

- One Year of COVID: Public Opinion

- One Year of COVID: Iran Compared to U.S.

- One Year of COVID: Infected Officials

Economic Growth

The International Monetary Fund (IMF) had initially projected zero GDP growth for 2020. After the pandemic hit, it revised its estimate to project that GDP would shrink by up to six percent. GDP ended up shrinking by just five percent in 2020, in part due to some growth in the last quarter of the year.

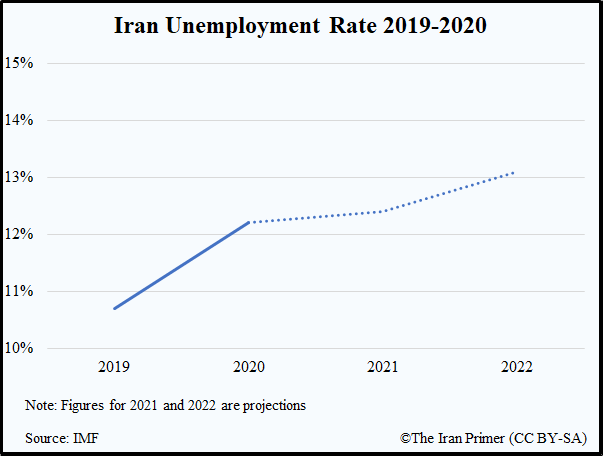

Job Loss

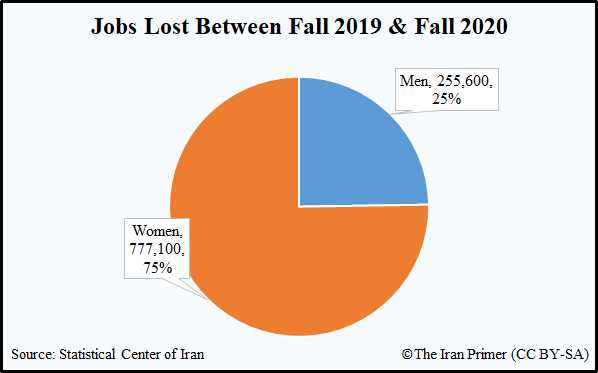

Unemployment rose to 12.2 percent in 2020 compared to 10.7 percent in 2019. More than one million people – in a labor force of 27 million – lost their jobs in 2020. The unemployment rate did not reflect that figure because many people reportedly stopped looking for work. Many of the people who lost their jobs were also employed in the informal sector, so their situation was also not necessarily reflected in the unemployment rate.

Working women were hit particularly hard. Three in four jobs that were lost between fall 2019 and fall 2020 were held by women.

Inflation and Rising Costs

In mid-2020, the prices of imported goods rose, partly due to border closures. The cost of domestic production also increased. By February 2021, inflation was at 48 percent, nearly double what it had been in February 2020.

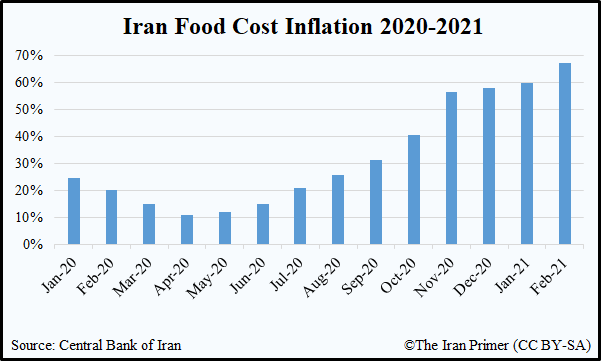

The rising cost of food hit poorer segments of the population the hardest in 2020. Half of Iranians said that their family reduced their consumption of red meat, according to a survey conducted by IranPoll for the University of Maryland's Center for International and Security Studies. Prices continued to soar during early 2021. During the Iranian month that ran from January 20 to February 18, 2021, produce prices were especially high:

• The price per 1 kg of cucumbers rose 47.4 percent from the previous month

• The price per 1 kg of eggplants rose 37.6 percent from the previous month

• The price 1 kg of bananas rose 33 percent from the previous month

Currency Decline

The value of Iran’s currency, the rial, declined steadily for most of 2020. The rial reached its weakest-recorded value – 322,000 rials against the dollar – in October. The rial strengthened somewhat in late 2020 after the Central Bank started injecting $50 million a day into the economy to boost the currency. Optimism about the end of President Donald Trump’s presidency and maximum pressure campaign also increased confidence in the currency. The rial stabilized by mid-December, hovering around 260,000 rials per dollar. But it had lost more than half of its value against the dollar in 2020.

Oil Industry

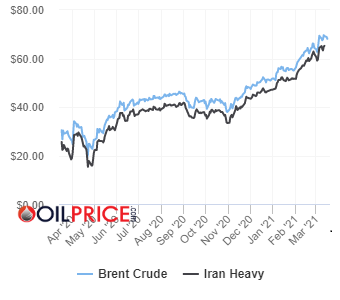

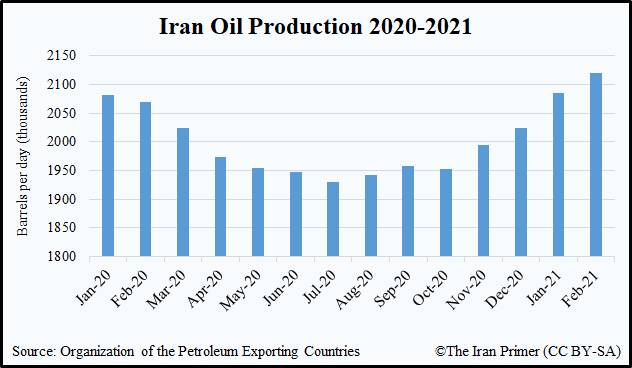

Iran faced a stunning decline in the price of oil – a major source of revenue – as an unexpected byproduct of the pandemic. By April 1, the price of Iran’s heavy crude fell to below $14 per barrel — down from $44 or more per barrel in February. The trend was worldwide. On April 22, Brent crude, a global benchmark, fell to a two-decade low of $15.98 a barrel — down from nearly $70 per barrel in early January.

Oil Prices Per Barrel 2020-2021

But in the second half of 2020, global oil prices recovered, which helped dampen the double blow of COVID-19 and sanctions on Iran’s economy. By August 2020, the price of Iranian heavy crude was hovering around $40 per barrel, close to pre-pandemic prices. Iran ramped up production as prices rose. In the last three months of 2020, some oil trackers estimated that Iran exported up to 900,000 barrels per day, potentially doubling sales from 2019. China bought most of Iran’s oil, either directly or through intermediaries.

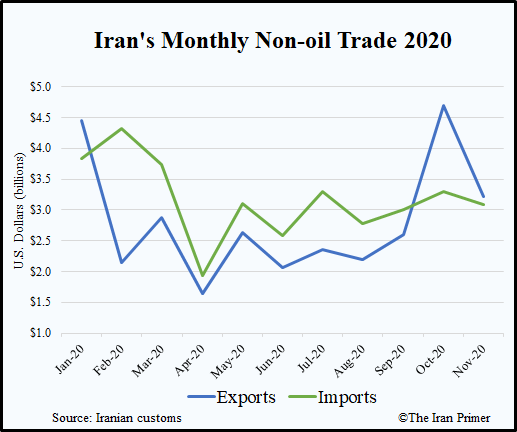

Non-Oil Trade

Border closures due to the pandemic significantly curtailed non-oil trade for in the early months of the pandemic. From March 20 to November 20, 2020 (the first eight months of the Persian year), Iran exported $21.5 billion in goods and imported $23.1 billion—a 20 percent reduction in overall trade compared to the same period in 2019. Trade recovered in late 2020 as Iran’s neighbors opened their borders.