Henry Rome is a senior fellow at the Washington Institute for Near East Policy, focusing on the Iranian economy, sanctions and nuclear diplomacy. Follow him @hrome2.

What was the state of Iran’s economy at the end of 2022? What were the prime challenges?

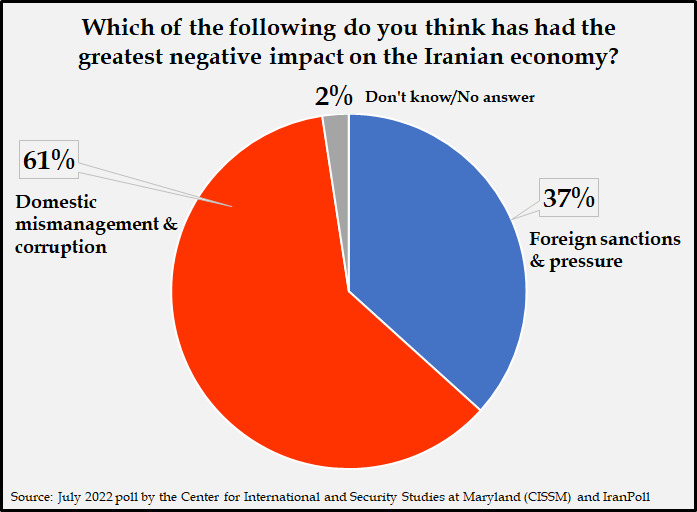

Iran’s economy was stuck in a period of low growth, high inflation and volatility, which hurt the economic prospects for millions of Iranians. The Islamic Republic’s foreign, fiscal and monetary policies combined to weaken the economy in 2022. These policies included the failure to revive the 2015 nuclear deal, the misguided implementation of reforms to subsidies for essential goods, unrealistic budgeting, and an overreliance on the Central Bank to indirectly support government spending.

The nationwide protests that began in September were sparked by the death of Mahsa Amini, a 22-year-old Kurdish woman detained by the morality police. Many demonstrators called for personal freedoms and the end of the Islamic Republic. But the dim prospects facing young people, who were at the forefront of the demonstrations, contributed to the explosion of anger. The protests and the government’s reaction, moreover, had their own economic effects. Periodic internet shutdowns affected small businesses that rely on social media for advertising and sales, and the overall turmoil appeared to hurt consumer demand and the broader business climate.

The nationwide protests that began in September were sparked by the death of Mahsa Amini, a 22-year-old Kurdish woman detained by the morality police. Many demonstrators called for personal freedoms and the end of the Islamic Republic. But the dim prospects facing young people, who were at the forefront of the demonstrations, contributed to the explosion of anger. The protests and the government’s reaction, moreover, had their own economic effects. Periodic internet shutdowns affected small businesses that rely on social media for advertising and sales, and the overall turmoil appeared to hurt consumer demand and the broader business climate.

Did Iran meet its budget projections — why or why not?

Iran was on pace to miss its budget expectations by a wide margin. In the first seven months of the Iranian year that began in March 2022, the government earned just two-thirds of the revenue it had expected by that point, and said that it expected that trend to continue. The release of the data triggered a clash in parliament in November. The chief of the Iranian budget organization blamed the shortfall on parliament’s insistence on social spending, an accusation that lawmakers rejected.

The government was expected to come close to its targets for tax revenue, which Tehran tends to project accurately, and it exceeded expectations for bond sales. But oil export revenue fell short of expectations. In the first six months of the Iranian year, Iran earned just 56 percent of the oil revenue it expected. This shortfall was not surprising; the government loses as much as half of expected oil revenue through discounts, smuggling costs and banking restrictions. It also fell short on customs revenue, earning just one-third of the expected revenue in the first six months, and in selling state-owned companies, where it earned almost nothing. To cover some of the shortfall, the government requested further withdrawals from the National Development Fund, the state’s sovereign wealth fund.

How did President Ebrahim Raisi manage the economy in 2022? What new policies did he implement?

Raisi’s most important economic policy decision in 2022 was reforming the system for subsidizing the importation of basic goods, including wheat. Dubbed “economic surgery,” the plan aimed to halt a longstanding policy of providing a more advantageous foreign exchange rate to some importers, which fostered corruption and depleted government coffers. The government said that it would pair the removal of the subsidy with a coupon system, theoretically alleviating the price increases that would follow the subsidy removal.

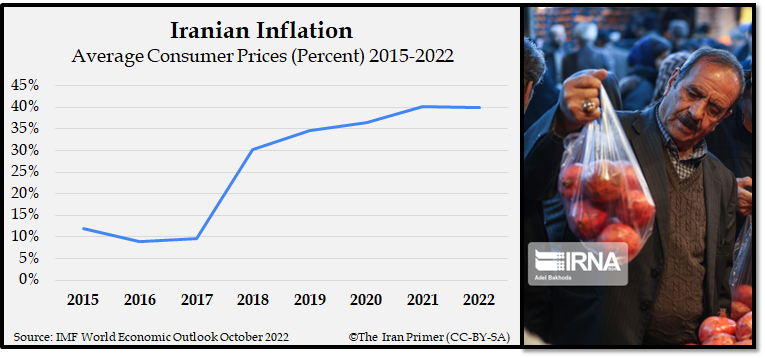

Yet, the reform was botched. The policy was announced abruptly in May, potentially motivated by the surge in global food prices following the Russian invasion of Ukraine. Protests over the spike in prices of bread and other staples broke out in dozens of cities and towns across the country. The coupon system was not ready. Inflation soared, with consumer prices rising more than 12 percent from May to June – the highest monthly rate since such statistics were published. The government deposited cash into people’s bank accounts as a temporary measure; this strategy was expected to be inflationary and widen the budget deficit. As of December, the coupon system had yet to be rolled out.

Yet, the reform was botched. The policy was announced abruptly in May, potentially motivated by the surge in global food prices following the Russian invasion of Ukraine. Protests over the spike in prices of bread and other staples broke out in dozens of cities and towns across the country. The coupon system was not ready. Inflation soared, with consumer prices rising more than 12 percent from May to June – the highest monthly rate since such statistics were published. The government deposited cash into people’s bank accounts as a temporary measure; this strategy was expected to be inflationary and widen the budget deficit. As of December, the coupon system had yet to be rolled out.

Did the so-called “resistance economy” have any successes?

Raisi and his economic team promote the “resistance economy” model, which prioritizes self-sufficiency. A key component of the strategy is to boost exports of high-value, non-oil products; Supreme Leader Ali Khamenei declared 2022 “the year of knowledge-based production and job creation.” Iran could claim some progress here. The industrial sector grew by 5.1 percent in the spring, led by the automotive and steel industries.

What were the major metrics of 2022?

- Inflation: The Statistical Center of Iran announced that consumer prices were 48 percent higher in November than they were a year earlier.

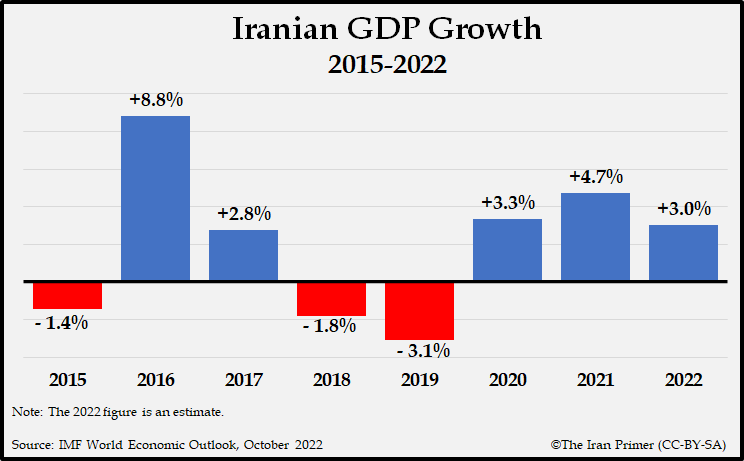

- GDP growth: In October, the International Monetary Fund and the World Bank forecast that the economy would grow 3 percent or 2.9 percent, respectively, in 2022/23. The most recent quarterly government data – from April-June 2022 – recorded growth of 3.8 percent but with contractions in key sectors including agriculture and construction.

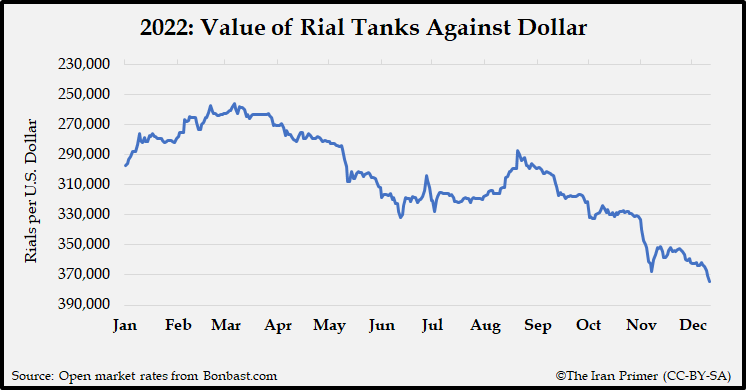

- Currency exchange rate: In mid-December, the Iranian currency hit an all-time low of nearly 400,000 rials to the dollar. The downward trend was particularly pronounced since late summer, when the United States and Iran failed to agree on the revival of the 2015 nuclear deal. Since the protests began in September, the rial lost about 20 percent of its value.

- Unemployment rates: In October, the IMF forecast unemployment in 2022/23 of 9.4 percent. The latest government report put summer 2022 unemployment at 8.9 percent and youth unemployment at 16.2 percent, both of them small declines. But the number of people in the labor market had fallen since the beginning of the pandemic in early 2020.

- Industrial production: The Purchasing Managers’ Index—a survey of business people that monitors economic trends—fell sharply in November, reflecting contractions in several sectors, including construction, services and agriculture. The industrial sector showed a slight increase.

How did the economy impact the average Iranian? How did prices for everyday goods change?

The high inflation rate eroded the purchasing power of Iranians, especially those in the lower classes or on fixed incomes. Average food and beverage prices increased by 68 percent in November compared to a year prior. The prices of tomatoes and onions, staples in Iranian cooking, both rose by about 16 percent in November compared to October.

How much oil did Iran export in 2022 compared to 2021? How did its oil revenues change in 2022? Who were its top trading partners?

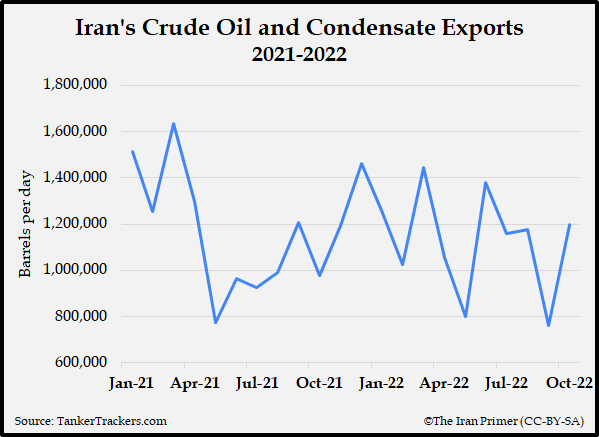

Since Iran does not publish export data and tries to conceal its oil trade, precise data is unavailable. But organizations that track Iran’s oil exports using satellites and other techniques – including TankerTrackers.com, Vortexa, Kpler and United Against Nuclear Iran – estimated crude and condensate exports as between 860,000 barrels per day (bpd) and 1.1 million bpd in 2022. The organizations differ on the comparison to 2021; some estimate the exports are comparable, while others assess exports rose by 32 percent in 2022.

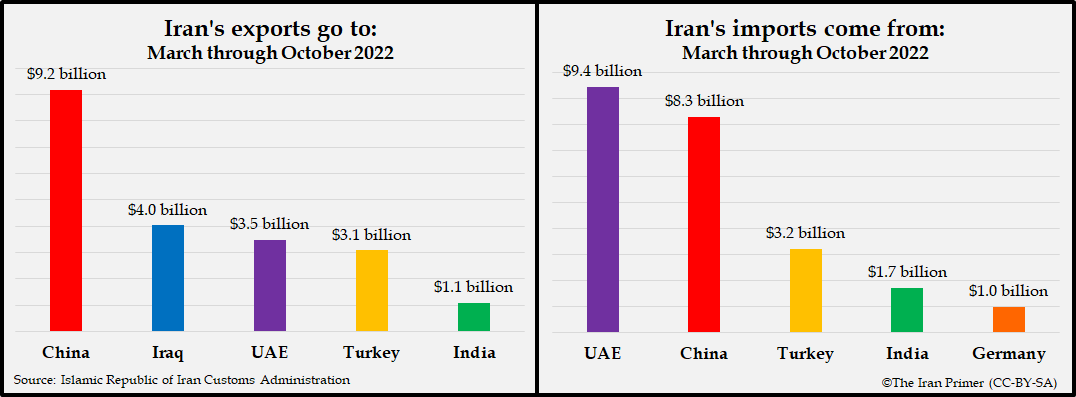

Iran exported oil primarily to China, with smaller volumes going to Syria and Venezuela. It also shipped oil to the United Arab Emirates (UAE), which was likely re-exported to Asia. Countries that previously imported Iranian crude or condensate, like India, South Korea, Japan, and European states, refrained from doing so, given U.S. sanctions. Oil exports were higher during the Biden administration than during the end of the Trump administration, largely due to a lack of aggressive sanctions enforcement.

Iran exported oil primarily to China, with smaller volumes going to Syria and Venezuela. It also shipped oil to the United Arab Emirates (UAE), which was likely re-exported to Asia. Countries that previously imported Iranian crude or condensate, like India, South Korea, Japan, and European states, refrained from doing so, given U.S. sanctions. Oil exports were higher during the Biden administration than during the end of the Trump administration, largely due to a lack of aggressive sanctions enforcement.

Importantly, Iran did not receive the sticker price for the oil it exported. It sold oil at steep discounts to compensate purchasers for taking the risk of violating U.S. sanctions. It also had to use circuitous routes both to move oil and bring the revenue home, hurting profits.

How much of Iran’s revenues were made off non-oil trade — and off what, and to whom?

In the eight months between the end of March and the end of November, Iran exported about $32 billion worth of non-oil goods and imported about $37 billion – resulting in a sizable trade deficit of almost $5 billion. The import-export gap was also reflected in a comparison to the 2021 period, with the growth in import value (15 percent) exceeding the growth in export value (four percent). While the overall value of trade was higher than in 2021, the amount of goods, as measured by weight, fell.

Iran’s top trade partners were China, the UAE, Turkey, Iraq, India and Germany. Its largest exports included petroleum products, petrochemical products and steel. (Gas condensate was likely among its top export products, although the specific data for those exports was not released on a national level.) Iran imported primarily food products and cell phones.

What new sanctions were imposed by the United States and other powers? How did U.S. sanctions impact Iran’s economy in 2022? Did new sanctions by the Biden administration add any meaningful limits on Iran’s economy or industries?

The United States imposed a variety of new sanctions in 2022, especially in the final quarter of the year as Iran’s crackdown against protesters and military cooperation with Russia intensified. The United States, the European Union, Britain and Canada imposed sanctions against 127 individuals and 18 entities allegedly involved in human rights abuses. But these designations were largely symbolic. The Western allies imposed several rounds of sanctions aimed at disrupting Iran’s sale of drones to Russia. Washington also imposed sanctions on companies involved in smuggling Iranian oil and petrochemical products.

Collectively, these sanctions probably had only modest macroeconomic impacts, compared with the weight of the sanctions Iran was already facing. Previous U.S. sanctions covered all of Iran’s important economic sectors and its ties to the global financial system, so the Biden administration primarily focused on enforcing existing restrictions.

What will be the biggest economic challenges facing Iran in 2023?

Raisi’s overarching challenge is addressing the government’s lack of credibility and capacity in tackling systemic issues, such as harnessing inflation, reviving the nuclear agreement or reforming the banking sector. This will be difficult for Raisi and his aides, who have shown little willingness to deal with such chronic issues. The deadly crackdown on protests in late 2022 probably further eroded public confidence in the state to pursue meaningful reforms. Without prospects for improvement, businesses and investors will likely continue to cut back on investment that the economy needs, and capital and people will continue to leave Iran.

Three other issues stand out. First, a significant decline in oil prices – driven, for example, by a worse-than-expected global recession or a decrease in China’s appetite for Iranian crude oil – would reduce the availability of hard currency needed to pay for imports. This, on top of an already widening trade deficit, could be difficult for the government to manage.

Second, competition with Russia may pose an added challenge. Despite their close political and security alignment, economic competition has intensified between Moscow and Tehran since the Russian invasion of Ukraine. As global oil markets adjust to new E.U. sanctions, including a cap on the price of Russian crude oil, Iran’s rivalry with Russia could become even more acute in Asia, potentially cutting into export revenues.

Related Material: Iran & Russia: Growing Economic Competition

Third, Iran is poised to face a series of energy-related challenges in 2023. Natural-gas consumption in 2022 increased by 60 million cubic meters per day compared to 2021, while production grew by only 25 million cubic meters per day. In December, the government began warning some factories to reduce usage and urged citizens to consume less gas to heat homes and offices. Iran experienced a similar shortage last winter, but amid the ongoing nationwide protests, disruptions in 2023 could be more politically sensitive. Gasoline consumption is also surging and investment in new refining capacity has lagged, so much so that officials have warned that Tehran may have to resume importing fuel. Iran announced it was a net exporter of gasoline in 2019 and reversing this would cut into government revenue. Gasoline is heavily subsidized in Iran, but raising the prices to cool demand would be politically explosive.