Cameron Glenn

The most significant development in January was the implementation of the nuclear deal, which awarded Iran partial relief from U.S., U.N., and E.U. sanctions. European and Asian companies quickly took steps to establish a foothold in the Middle East’s second largest economy.

Days after the deal was implemented, Iran engaged in a number of high-profile diplomatic visits. Chinese President Xi Jinping visited Iran on January 22 and 23 and signed 17 agreements. It was his first visit to the Islamic Republic. Two days later, President Hassan Rouhani embarked on his first trip to Europe. During the four-day visit, Iran inked deals worth

$43 billion with French and Italian companies. China, Italy, and France were major trade partners with Iran before sanctions were tightened in 2010, and all are eager to boost economic ties.

Nonetheless, there may be limits to Iran’s economic windfall from sanctions relief. Some companies are more cautious to pursue business in the Islamic Republic, fearing they will run afoul of remaining U.S. sanctions for terrorism and human rights violations. Iran’s

corruption and

difficult business environment may also deter foreign investors. And as Iran prepares to ramp up oil and gas exports, it must contend with low oil prices and the need for billions of dollars of investments. The following is a rundown of major economic developments in Iran in January.

Sanctions Relief

January 16 marked the nuclear deal’s Implementation Day. After the U.N. nuclear watchdog determined that Iran had fulfilled its commitments under the agreement, the Islamic Republic received long-awaited relief from economic sanctions that have crippled its economy. “Today is a historical and exceptional day in the political and economic history of the Iranian nation,”

said President Hassan Rouhani. A U.N. arms embargo and ballistic missile restrictions on Iran will remain in place, as will non-nuclear U.S. sanctions.

Iran also gained access to billions of dollars on Implementation Day. The Islamic Republic holds at least $100 billion in frozen assets, but much of that amount is tied up in debts or other pre-existing obligations. As a result, Iran may receive closer to $55 billion, according to U.S. Secretary of State

John Kerry and Treasury Secretary

Jacob Lew. Iran’s central bank governor

Valiollah Seif, however, claimed in January that only around $30 billion would be available to Iran immediately. After Implementation Day, Seif reported that Iran had transferred funds from some of its overseas assets in held banks in Japan and South Korea, though he did not specify how much.

Iran also regained access to the international financial system.

SWIFT, a Belgian system used to transmit payments, reportedly began the process of restoring service to Iranian banks. But U.S.-based payment systems – including credit cards – will still not function in Iran.

Foreign Investment

On January 16,

Rouhani said the nuclear deal "opened new windows for engagement with the world." He estimated that Iran needs

$50 billion annually in foreign investments to reach its goal of eight percent growth. Central Bank Governor Valiollah Seif

said on January 20 that the $50 billion figure “isn’t farfetched” and that investment could offset the impact of low oil prices. According to the president’s chief of staff

Mohammad Nahavandian, “Iran may be one of the most promising emerging markets of the coming decades.”

Foreign companies have been flocking to Iran since before the nuclear deal was signed. More than 140 economic delegations from 48 countries visited Iran between March and December 2015, according to

Mir-Abutorab Badri, an official with the Trade Promotion Organization of Iran. Around half of them were from Europe and North America.

In January, some companies quickly took steps to re-enter the Iranian market.

Daimler, a large German manufacturer of commercial vehicles, reached preliminary agreements to produce and sell trucks in Iran. European firms including Airbus, Peugeot, Danieli, and Saipem signed deals during Rouhani’s trip to Italy and France.

Other firms, however, are concerned that investing in Iran could backfire in the event of “snapback” sanctions or policy changes under the next U.S.

president. Foreign companies are restricted from trading with more than

200 Iranian entities still sanctioned by the United States for non-nuclear reasons. Corruption, lack of transparency, poor

transportation infrastructure, and other issues in Iran’s

business environment could also deter potential investors. Iran ranks

119th out of 189 countries in the World Bank’s ease of doing business index, and

136th out of 175 countries in Transparency International’s corruption perceptions index.

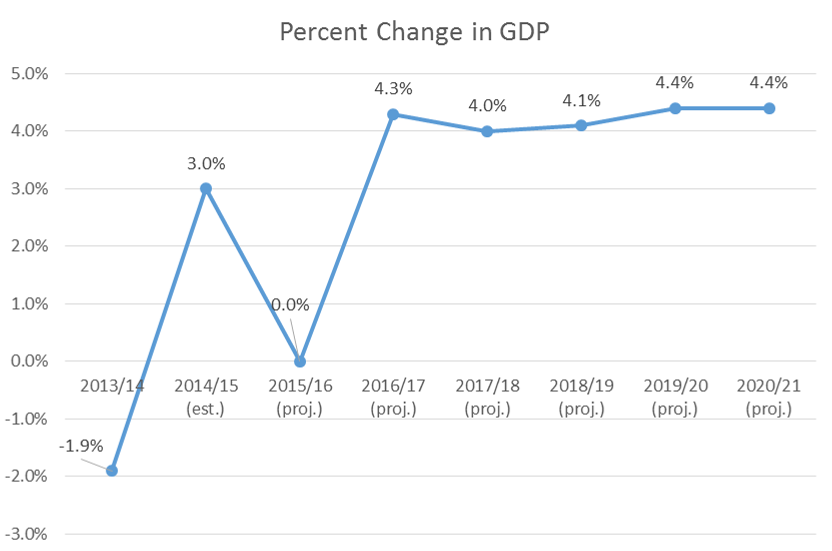

Growth

Iran’s economy could achieve five or six percent growth in the next Iranian calendar year, which begins in March, according to Central Bank Governor

Valiollah Seif. In a January 11 speech, President Rouhani echoed Seif’s optimism. “Despite all difficulties this year, economic growth of the country will be positive and I assure the people of Iran that next year (1395) will be the year of economic growth,” he

said. The

International Monetary Fund predicts Iran’s economy will grow between four percent and 5.5 percent next year.

State Budget

On January 17, Rouhani presented a draft budget of

$75 billion to parliament. The budget was around 4.2 percent higher than the previous year, with the expectation that sanctions relief will boost the economy. Government spokesman Mohammad Bagher Nobakht noted that only

25 percent of Iran’s state budget will depend on oil revenues, compared to around

60 percent in the past few years.

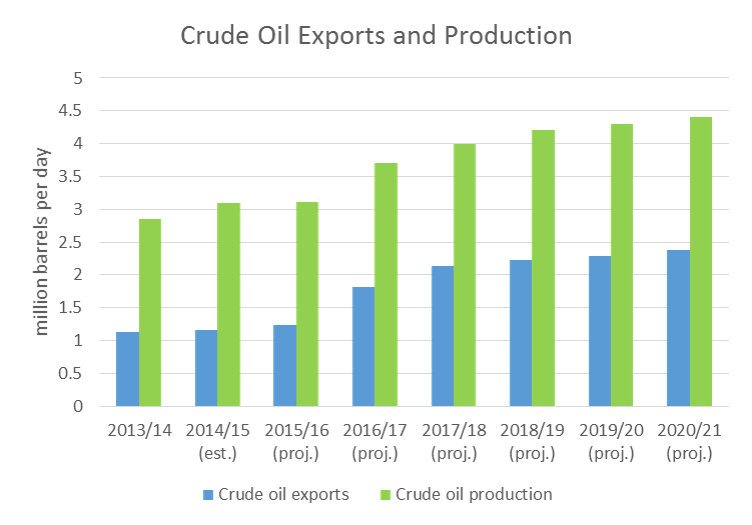

Oil

On January 13, oil prices fell below

$30 a barrel for the first time in 12 years. Oil Minister

Bijan Zanganeh blamed the low prices on political motivations behind overproduction. “There is a political will behind OPEC indecision over the production ceiling in the organization,” he said.

Despite low prices, Iran plans to quickly increase oil production. After Implementation Day, Iranian officials ordered an increase in production of

500,000 barrels per day, which they hope to achieve within six months. They planned to increase output by

1 million barrels per day within a year. “If Iran does not increase its oil production, neighboring countries may increase their production…and take Iran’s share,”

said Rokneddin Javadi, head of Iran’s National Oil Company.

In its January oil market report, the International Energy Agency noted that “There are considerable uncertainties around the quality and quantity of oil that Iran can offer to the market in the short term and the not inconsiderable challenge of finding buyers willing to take more oil into an already glutted market.” The agency also predicted that global oil supply could exceed demand by 1.5 million barrels per day in the first half of 2016. Iranian officials, however, remained optimistic. “There are [oil] customers, and there have been negotiations in this regard,” Zanganeh said on January 19.

In late January, Iran’s

Bank Mellat set up accounts with European banks to collect billions of dollars of overdue oil payments. Iran signed

deals with Russian oil company

Lukoil, Greek oil refiner Hellenic Petroleum, Italian oil services company Saipem SpA, and Italian energy group Ansaldo Energia.

On January 30, a group of students protested outside the Iranian Oil Ministry against the new Iran Petroleum Contract (IPC), chanting that the contracts would lead to the “

plundering of national wealth.” The Oil Ministry introduced the IPC to replace the old “buy-back” contracts unpopular with foreign firms. Amid the protests, the National Iranian Oil Company announced that it postponed an

oil conference in London due to issues obtaining visas.

Natural Gas

On January 11, President Rouhani attended the inauguration of phases 15 and 16 to develop the

South Pars field, the largest gas field in the world. Iran plans to complete phases 17-21 of its 24-phase development plan within the next Iranian calendar year, according to

Managing Director of the Pars Oil and Gas Company Ali Akbar Shabanpour.

Tehran hopes to increase gas exports and secure

$40 billion in foreign investments now that sanctions are lifted. On

January 19, Managing Director for International Relations of the National Iranian Gas Company Azizollah Ramezani said that Iran “is well-placed to sell gas to all countries,” including Europe.

Exporting natural gas requires expensive pipeline infrastructure or liquefaction – a process that liquefies natural gas and makes it easier to export. Building this infrastructure would cost

billions of dollars and take years. On January 26, Managing Director of the National Iranian Gas Exports Company

Alireza Kameli said that Iran was pursuing the development of liquefied natural gas (LNG) capabilities and hopes to be able to export LNG to Europe by

2018. Kameli also said in January that Iran was in the midst of negotiations to export gas to

Oman and use its vacant LNG facilities.

Aviation

Iran hosted its first

aviation summit in 40 years on January 24 and 25, attended by representatives from more than 100 companies. “Airplane building companies are all eying a greater share in the country’s market,” said Secretary of Iran’s Aviation Companies Association

Maghsoud Asadi Samani. Foreign airlines, including Air France-KLM SA, Lufthansa AG’S Eurowings, Austrian Airlines, and Emirates Airline, all plan to

increase flights to Tehran.

During Rouhani’s trip to France, Iran Air signed a

$25 billion deal with

Airbus to purchase more than 100 commercial jets. Iran also negotiated a deal to buy up to 40 passenger planes from France-based company

ATR. Deputy Transport Minister Asghar Fakhrieh Kashan indicated that the Islamic Republic is interested in purchasing planes from

Boeing, the world’s largest aircraft manufacturer. But the U.S.-based company is reportedly still assessing the potential risk of sanctions violations.

Iran has one of the world's oldest aircraft fleets due to years of sanctions. The Islamic Republic currently has

251 passenger planes, but around 100 are out of service due to difficulties obtaining spare parts. Iran needs to buy 500 planes to update its fleet within the next 10 years, according to Minister of Roads and Urban Development

Abbas Akhundi.

United States

Implementation Day resulted in only modest changes to trade ties between Iran and the United States.

The deal lifts some restrictions on foreign subsidiaries of American companies. But U.S. businesses are still largely barred from trading with Iran, as sanctions for terrorism and human rights violations remain in place. There are limited exceptions for aviation, carpets, and other goods.

On January 15, President Barack Obama issued a

presidential memorandum allowing civilian aircraft exports to Iran. Sanctions had prohibited U.S. manufacturers from selling planes, though the 2013 interim nuclear deal lifted bans on selling

spare parts.

Reports circulated in late January that the United States and Iran were in talks to establish direct commercial flights between the two countries, but U.S. officials

denied the claims.

Iran plans to resume its shipments of saffron to the United States for the first time in 15 years, according to the head of Iran’s Saffron Exports Development Fund Mohammad-Javad Rezaie. Iran will also resume carpet exports to the United States in 2016.

China

Chinese President Xi Jinping visited Iran on January 22-23, following visits to Egypt and Saudi Arabia. Chinese and Iranian officials signed 17 agreements in energy, industry, transportation, technology, and other fields. The two countries also released a joint statement outlining broad goals for cooperation in politics, economics, cultural affairs, security issues, and foreign policy.

“Geographically, Iran has got the capacity to become a hub for China’s economic activities in the Middle East and Central Asia and Caucasus,” Rouhani

said during the meeting with Xi Jinping. "In cooperation with the Iranian side and by benefiting from the current favorable conditions, China is ready to upgrade the level of bilateral relations and cooperation so that a new chapter will start," the Chinese President

said after the meeting.

China has been Iran’s largest trade partner since

2009, and it continued to buy Iranian oil after sanctions were tightened in 2012. Iran is keen to secure Chinese investment in its ailing oil and gas industry. President Xi also considers Iran to be a crucial component to his “One Belt One Road” initiative, which aims to build transportation infrastructure across Central Asia and is framed as a renewal of the

Silk Road.

Italy

During Rouhani’s visit to Italy from January 25 to 27, Iran and Italy signed around

$18.4 billion in deals for cooperation in energy, infrastructure, shipbuilding, and mining. The two countries signed 14 MoUs, including a deal with the

Parsian Oil & Gas Development Company to upgrade the Pars Shiraz and Tabriz refineries. Iran also signed more than $6 billion in contracts with steel firm

Danieli. On January 27, Iran and Italy issued a joint statement outlining a

roadmap for bilateral cooperation.

Italy was Iran’s

largest European trade partner before sanctions were tightened in 2010. Sanctions forced Italy to cut bilateral trade to one fifth of its previous volume. "After the JCPOA, we are more eager to have Italians before any other European nations to start a constructive interaction with their Iranian partners in the economic fields," Rouhani said in a

meeting with Italian Prime Minister Matteo Renzi on January 25.

France

Rouhani arrived in France on January 27 for meetings with French Foreign Minister Laurent Fabius, President Francois Hollande, and a group of French business leaders. On January 28, French and Iranian officials signed

20 agreements for economic, political, and cultural cooperation. During Rouhani’s visit, French Foreign Minister Laurent Fabius

said that “Iran is a great country with a bright prospect, and today major French companies are seriously determined to start cooperation with Iran.” Iranian ambassador to France

Ali Ahani said that French President Francois Hollande plans to visit Iran after the Iranian new year in March.

French companies signed a series of lucrative business deals with Iran in January. French automaker Peugeot announced it had reached a deal with Iran Khodro worth

$436 million to manufacture

200,000 cars per year in Iran. Energy company

Total signed a deal to buy up to 200,000 barrels of Iranian crude oil per day. Airbus finalized a deal to deliver more than

100 commercial jets to Iran. And Bouygues and Aeroports de Paris are in talks with Iran to build a second terminal at Tehran’s

airport.

United Kingdom

Rouhani said that “The Islamic Republic of Iran welcomes European companies and transfer of capital and technology in finance and banking,” in a

phone call with British Prime Minister David Cameron on January 19. He added that “This resolve between the top officials of both countries has provided a serious momentum for relations.” Deputy Head of Iran’s Civil Aviation Organization (ICVO) Mohammad Khodakarami said on January 27 that a

British Airways delegation had arrived in Tehran to discuss resuming flights.

After Implementation Day, the

Bank of England reactivated licenses for Persia International Bank, Bank Melli, and Bank Sepah International, who will be allowed to resume operations once they take steps to comply with U.K. financial regulations.

South Korea

On January 25, South Korea opened a

business center to facilitate trade between Korean and Iranian companies. The Export-Import Bank of Korea plans to provide more than $5 billion in financing for Korean companies who wish to do business in Iran. South Korean President

Park Geun-hye is reportedly considering a trip to Iran, which would be the first visit by a South Korean president to the Islamic Republic.

Egypt

In January, Iran and Egypt resumed oil trade, which had been halted in

2012. “Iran has no limitations on the sale of crude oil and oil products to Egypt, and any official request will be considered when it is made,” Managing Director of the National Iranian Oil Company Roknoddin Javadi

said. Iran and Egypt severed diplomatic ties in 1980 after Cairo offered refuge to the shah.