Cameron Glenn

For Iran’s economy, 2015 was a year of high expectations and slow results. The historic nuclear deal in July – and the promise of sanctions relief – initially raised hopes among foreign companies eager to tap into the Middle East’s second largest economy (after Saudi Arabia). Iranians expected to quickly notice improvements in their quality of life. But by the end of 2015, tangible economic benefits had yet to materialize.

The Islamic Republic still faced significant challenges, triggered not only by sanctions, but by years of profligate spending and economic mismanagement. Iran was even slipping towards a recession. Domestic production stagnated. Low oil prices squeezed the state budget. And unemployment remained stubbornly above ten percent.

In October, President Hassan Rouhani approved a six-month stimulus package – a notable shift from his economic policies focused on improving fiscal discipline. He hoped to stimulate growth before the parliamentary elections and the implementation of the nuclear deal. But the move threatened to undermine his efforts to reduce inflation.

In October, President Hassan Rouhani approved a six-month stimulus package – a notable shift from his economic policies focused on improving fiscal discipline. He hoped to stimulate growth before the parliamentary elections and the implementation of the nuclear deal. But the move threatened to undermine his efforts to reduce inflation.Rouhani faced pressure to deliver on the economic promises that Iranians – and a host of foreign companies – so eagerly anticipated. His administration may struggle to bridge the gap between economic expectations and reality, even after sanctions are lifted in 2016.

International Trade

Some U.N., E.U., and U.S. sanctions were due to be lifted or suspended on the nuclear deal’s Implementation Day, expected in early 2016. But foreign companies began flocking to Iran even before the deal was signed. In 2015, Tehran hosted a flurry of trade delegations and signed new contracts to boost cooperation in energy, transportation, and other sectors.

Around 60 foreign delegations visited Iran between March and November, according to deputy economy minister Mohammad Khazaei. At least a dozen were from Europe, many of which had been active in Iran before sanctions were tightened in 2010.

Barely six days after the deal was signed, German Economy Minister Sigmar Gabriel met with officials in Tehran to discuss expanding “lasting and stable economic cooperation.” A week later, French Foreign Minister Laurent Fabius visited Tehran for the same purpose. It was the first visit to Iran by a French foreign minister in 12 years. Italy, which used to be one of Iran’s major trade partners, sent a delegation of 300 businessmen in early August.

#Sanctions crumble in #Europe’s rush to #Iran http://t.co/m7XU1iwM6q #IranDeal pic.twitter.com/4kbPsTQcCF

— Iran (@Iran) August 6, 2015The deal may strengthen Iran’s economic ties with Europe, but it is unlikely to have the same impact for the United States. U.S. sanctions relief will generally be limited to nuclear-related restrictions on non-U.S. entities. American companies will still be prohibited from trading with Iran. Limited exceptions include civil aviation, carpets, pistachios, and caviar.

By the end of the year, Iranian officials had made it clear that the Islamic Republic did not intend to improve trade ties with the United States. On November 5, Minister of Industry, Trade, and Mines Mohammad Reza Nematzadeh said that Iran must “stop entry of American consumer goods and…prohibit products that symbolize the presence of the United States in the country.”

High Hopes and Disappointments

The prospect of sanctions relief fueled optimism among Iranians in 2015. In May, around 55 percent of Iranians expected to see tangible improvements in living standards within a year of the deal being signed, according to a poll from the Center for International and Security Studies at Maryland. By September, the figure had risen to 63 percent.

Iran’s crude oil exports will rise to a six-month high in December ahead of sanctions relief https://t.co/63aRP5YHAs pic.twitter.com/3tD2Fz9VjY

— Press TV (@PressTV) December 15, 2015The hopes were not unfounded. In October, the International Monetary Fund predicted that Iran’s economy could grow 4.4 percent in 2016 if sanctions are lifted – an increase from its projection of 1.3 percent growth in April, before the deal was signed. Valiollah Afkhami-Rad, head of Iran’s Trade Development Organization, said on July 27 that exports and domestic production may rise at least 20 percent after sanctions are lifted. In November, Central Bank vice governor Gholamali Kamyab predicted that around $29 billion of Iran’s $100 billion frozen funds would be repatriated by early 2016. And Oil Minister Bijan Zanganeh announced that Iran would increase oil production from 2.9 billion barrels per day to 3.9 billion barrels per day by March 2016.

Paradoxically, the anticipation of better economic prospects had a negative impact on the economy in late 2015. First Vice President Es’haq Jahangiri blamed high expectations for oversupply and low demand in several industries. “Unfortunately, some people are expecting a sudden fall in prices after the implementation of the nuclear agreement,” he said on September 12. Economy Minister Ali Tayyebnia also linked high expectations to low domestic spending on cars and home appliances.

The auto industry – Iran’s largest non-oil sector – struggled in the months following the nuclear deal. Sales were low, as Iranians anticipated price decreases and imports of higher quality cars once sanctions are lifted. In August, a social media campaign in Iran began calling for a boycott of Iranian-made cars due to poor quality and safety standards. Minister of Trade, Mining, and Industry Mohammad Reza Nematzadeh called the boycott “sinful” and “anti-revolutionary,” arguing it would hurt the economy. Iran’s steel and cement industries also stagnated in 2015 from high supply and low demand.

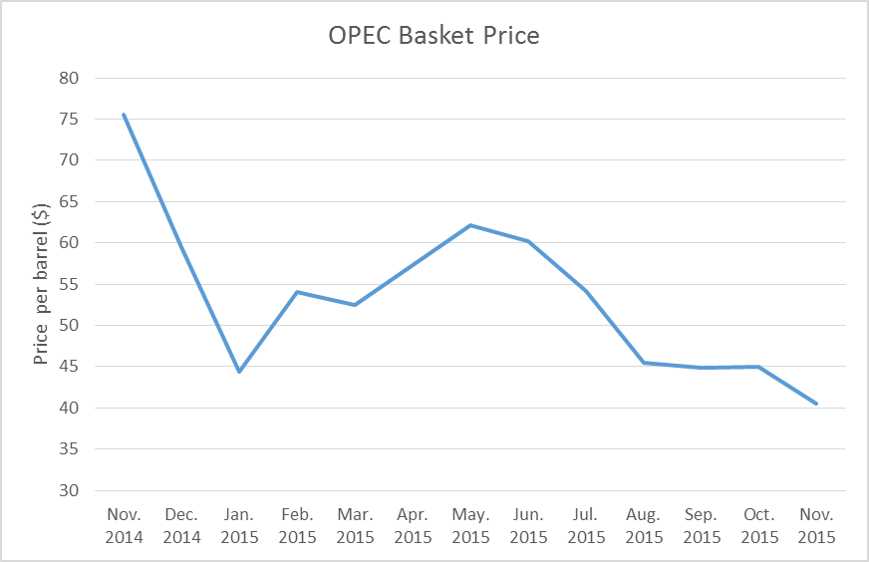

Lifting sanctions will likely provide some relief for Iran’s ailing economy, but may not be a panacea. Low oil prices presented another economic challenge in 2015. In January, the government revised its draft budget to assume an oil price of $40 a barrel. The initial budget that President Rouhani presented to parliament was based on $72 a barrel, down from $100 in the 2014 budget. Iran’s oil and gas infrastructure also lagged far behind its Gulf neighbors. Once sanctions are lifted, Iran hopes to secure a staggering $185 billion in oil and gas investments by 2020.

Source: OPEC

Rouhani’s Policies

Rouhani shifted gears to cope with economic pressures at the end of 2015. During his first two years in office, he had largely focused on improving fiscal discipline and modifying or reversing the populist policies of former President Mahmoud Ahmadinejad. Rouhani’s key achievement was reducing inflation to 14.8 percent by 2015, down from nearly 40 percent when he took office in August 2013.

For much of 2015, Rouhani stuck to similar policies. He tackled subsidy reform by raising gasoline prices twice and suspending monthly cash handouts to three million wealthy Iranians. All Iranians – regardless of income – had been eligible to receive the payments, but they have increasingly strained Iran’s state budget.

#Iran widens #cash handout cancellations http://t.co/Upioy3PtO3 #Economy pic.twitter.com/g843yGb3oR

— Iran (@Iran) August 3, 2015Reducing dependence on oil revenues became another key focus for his administration, especially as oil prices dropped. “We should have a variety of revenue sources, we cannot depend on a single source of income,” he said in January. On June 15, he announced that Iran’s 2015-2016 budget was “the least oil-dependent ever.”

By the end of the year, Rouhani faced new pressure to ward off a recession. In September, the ministers of economy, industry, labor, and defense sent Rouhani an open letter warning of economic decline. “If urgent action is not taken, stagnation could turn into crisis,” it said. The ministers blamed sanctions, low oil prices, and “uncoordinated decisions and policies.”

In October, Rouhani approved a six-month stimulus package, marking a significant change in policy. It was designed to inject cash into the economy and stimulate growth before sanctions are lifted. The timing of the policy shift suggests it may have been intended to help Rouhani score political points ahead of Iran’s elections for parliament and the Assembly of Experts. Some experts, however, warned that the move could increase inflation and jeopardize Iran’s economic recovery.

Low oil prices and structural problems may continue to stymie economic recovery in 2016. According to the World Bank, Iran still needs to improve its business environment, reduce the influence of state-owned enterprises, and reform its financial sector in order to see tangible benefits in growth and job creation.

Key Industries

Oil

- Foreign oil companies have sought opportunities to resume work in Iran – which holds the world’s fourth largest oil reserves – since the nuclear deal was signed in July. In October, representatives from 10 major oil, gas, and petrochemical companies visited Tehran to discuss investment opportunities. They included oil giants previously active in Iran, such as France’s Total and Italy’s ENI.

- Iran hopes to lure back foreign oil companies by offering more favorable contract terms. In November, Iran introduced the Iran Petroleum Contract (IPC). Unlike the “buy-back” contracts unpopular with foreign firms, the IPC allows companies to participate in all the stages of an oil or gas field’s lifecycle.

- Iran’s crude oil production hovered around 2.9 million barrels per day in September. Oil Minister Bijan Zanganeh predicted it could rise to 3.9 million barrels per day by March 2016, if sanctions are lifted.

Natural Gas

- Iran holds the world’s second largest natural gas reserves. Some officials speculated in 2015 that the Islamic Republic could eventually replace Russia as a natural gas supplier to Europe. But new exports would require expensive new pipeline infrastructure or liquefaction facilities, which would cost billions of dollars and take years.

- Deputy Oil Minister for Commerce and International Affairs Amir-Hossein Zamaninia said on July 23 that Iran could feasibly deliver liquefied natural gas to Europe within five to 10 years. In September, Oil Minister Bijan Zanganeh met with officials from Poland and Spain to discuss the possibility of exporting liquefied natural gas to the two countries. European companies estimated that Iran could supply Europe with up to 35 billion cubic meters of gas per year by 2030.

- Other Iranian officials have approached the issue with more caution. In May, Mohsen Ghamsari, a director at the National Iranian Oil Company, said that exporting natural gas to Europe was not “economically feasible.” In November, deputy head of the National Petrochemical Company Mohammad Hassan Peyvandisaid that it would not be “economically justified” for Iran to export liquefied natural gas in the immediate future.

- In April, Zanganeh announced that Iran plans to increase gas production to 200 million cubic meters per day by April 2016. “This is what we planned by assuming that the sanctions will remain in place,” he said. “If the sanctions are removed, things will proceed much faster.”

Auto Industry

- Iranian car production rose 8.7 percent in the first five months of the Iranian calendar year (March-August 2015), but sales of Iranian cars dropped 15 percent in the same period.

- Western automakers left Iran due to sanctions, but several companies – including Fiat Chrysler, Volkswagen, Mercedes-Benz, and Peugeot – have expressed interest in returning to Iran once sanctions are lifted.

- On July 29, Iranian automaker Iran Khodro and German automaker Mercedes-Benz announced they plan to sign a five-year deal to distribute Benz cars in Iran and a 10-year deal for production of commercial vehicles. Iran Khodro has also held discussions with Volkswagen and French automaker Peugeot. It hopes to expand ties with Renault and Suzuki as well, according to CEO of Iran Khodro Industrial Group Hashem Yekeh Zareh.

‘Iran automobile industry eyes foreign markets in 10-year vision’ http://t.co/xMmPjTSlZz pic.twitter.com/psdwtLQTg5

— Press TV (@PressTV) September 29, 2015Steel

- Iran’s steel industry struggled in 2015, plagued by low demand, high production costs, and competition from low-quality steel products from China.

- In October, steel demand was at an all-time low, and production dropped for the third straight month. Iranian steel exporters shifted focus to domestic production, seeking $20 billion to develop the steel industry and triple production within ten years.

- In November, the Iran Steel Producers Association called on the government “to help the steel industry move out of recession.”

- Also in November, two Italian companies proposed a four billion euro deal to participate in Iranian steel and aluminum projects.

Cement

- Iranian cement exports – a key non-oil industry – declined by 30 percent in the first five months of the Iranian calendar year.

- Iran is the largest cement producer in the Middle East, but it has struggled in the past few years from low demand, sanctions, and competition from other cement producers such as Turkey.

Energy

- The water and electricity sectors have suffered from lack of investment over the last few years and uneven implementation of President Mahmoud Ahmadinejad’s subsidy reform program.

- Energy Minister Hamid Chitchian warned in February that electricity shortfalls are hindering economic growth. The sector “has consistently been weakened over the past five years, and investment has dramatically decreased,” he noted. Energy demands are reportedly growing at about six percent a year while growth is less than a third of that.

- Iran hopes to earn $50 billion in investments for water and electricity projects once sanctions are lifted, according to Energy Minister Hamid Chitchianin August. The projects would take around 20 years to complete.

Timeline of Foreign Economic Delegations in 2015

January 20: Iran’s largest car maker, Iran Khodro, signed an agreement with France’s Renault to import two models of cars in early or mid-2015.

January 28: Ali Akbar Velayati, a top advisor to the supreme leader, visited Moscow and met with President Vladimir Putin. The two agreed to coordinate efforts to upgrade Iran’s observer status within the Shanghai Cooperation Organization. Velayati also met with Russian Foreign Minister Sergei Lavrov and Energy Minister Alexander Novak.

April 2: Iran and the world’s six major powers reached an agreement on the framework for a nuclear deal.

April 7: Rouhani and Turkish President Recep Tayyip Erdogan signed eight agreements to increase bilateral trade, aiming to increase trade volume to $30 billion by the end of 2015.

April 13: Russia began implementing an oil-for-goods deal with Iran. “In exchange for Iranian crude oil supplies, we are delivering certain products,” said Russian Deputy Foreign Minister Sergei Ryabkov. “This is not banned or limited under the current sanctions regime.”

April 13: France’s Total indicated that it would be interested in reviving oil and gas investments in Iran, if sanctions are lifted. “Iran has the world’s second largest gas reserves after Russia, and we will consider returning to this country once sanctions are lifted,” said Total CEO Patrick Pouyanne.

April 28: A Swiss business delegation met with Gholam Hossein Shafei, head of Iran's Chamber of Commerce. The two sides discussed expanding bilateral trade.

May 6: Iran and India signed a memorandum of understanding to develop the strategic Chabahar port in southeast Iran. Plans to develop the port date back to 2003, but were delayed by international sanctions on Iran.

May 10: Foreign Minister Mohammad Javad Zarif met with his South African counterpart, Maite Nkoana-Mashabane, in Tehran. Zarif described Iran’s relationship with South Africa as “friendly and strategic” and noted the potential for economic cooperation in the oil and gas industry.

July 14: Iran and the world’s six major powers reached a final nuclear deal.

Meeting with #German Vice Chancellor now. Iran-Germany Joint Commission for Economic #Cooperation to be held in 2016 pic.twitter.com/IgeTeuHoAt

— Hassan Rouhani (@HassanRouhani) July 20, 2015July 20: German Economy Minister Sigmar Gabriel became the first high-level European official to visit Iran after the deal was announced. “German companies are not only prepared to sell products to Iran, but also seek to expand lasting and stable economic cooperation [with Iran],” Gabriel said. But he also indicated that closer economic ties would depend on Iran improving its stance towards Israel. Gabriel was accompanied by a delegation of businessmen, and met with several Iranian officials including Oil Minister Bijan Zanganeh.

July 28: Iranian Deputy Foreign Minister for Asia and Pacific Affairs Ebrahim Rahimpour met with Chinese foreign minister Wang Yi, reinforcing China’s role as a strategic partner for Iran.

July 29: Foreign Minister Laurent Fabius visited Iran on July 29, meeting with Iranian Oil Minister Bijan Zanganeh and other senior officials. It was the first visit to Iran by a French foreign minister in 12 years.

August 4-5: Italian Economic Development Minister Federica Guidi visited Iran with a team of 300 businessmen. Investment bank Mediobanca, Italy’s development ministry, and export credit agency SACE signed a memorandum of understanding “to facilitate future economic and commercial relations between the two countries.”

August 23: British Foreign Secretary Philip Hammond reopened the British Embassy in Tehran. Central Bank of Iran Governor Valiollah Seif announced that two Iranian banks would open in Britain.

Leading #UK business delegation with @damian57 to discuss future opportunities in #Iran for British business. pic.twitter.com/Gsqbvq6b0M

— Philip Hammond (@PHammondMP) August 23, 2015September 8: Austrian firms signed contracts and memoranda of understanding with Iran totaling $89 million during Austrian President Heinz Fischer’s visit to Tehran. Fischer was the first European head of state to visit the Islamic Republic since 2004. Iran and Austria hope to increase bilateral trade from $300 million per year to $1 billion per year by 2020.

September 17: South Africa – formerly the leading African importer of Iranian oil – signed a deal to increase oil imports from Iran once sanctions are lifted.

September 21: France opened a trade office in Tehran during a visit from a business delegation with representatives from Airbus, Renault, Peugeot, and Total.

October 2: A British economic delegation, which included oil and gas companies, visited Iran.

October 12: The Japanese foreign minister met with Oil Minister Bijan Zanganeh in Tehran to discuss increasing oil imports once sanctions are lifted.

October 26: Brazilian Minister of Development, Industry, and Trade Armando Monteiro arrived in Tehran with a delegation to discuss improving economic ties with Iran. They hope to increase trade volume to $5 billion.

November: Two Italian companies proposed a four billion euro deal to participate in Iranian steel and aluminum projects.

November 2: Iran negotiated the potential for natural gas trade with Kuwait once sanctions are lifted. “Kuwaitis are looking to import natural gas from Iran,” according to managing director of National Iranian Gas Export Company Alireza Kameli.

November 18: A delegation representing 26 French oil companies discussed potential cooperation with officials in Tehran.

November 24: Russia and Iran signed seven memoranda of understanding on the sidelines of the Gas Exporting Countries Forum.

Cameron Glenn is a senior program assistant at the U.S. Institute of Peace.

Photo credits: U.S. Department of State