By John Prentice Caves III

Iran and India have had a complex trade relationship built around oil — dating back to the days of the British Raj — that was abruptly terminated in early 2019 by U.S. sanctions. The trade had literally fueled both countries’ economies, although Iran depended more on India. By 2012, India was the second largest importer of Iranian oil, after China. India bought oil even when Iran was sanctioned between 2006 and 2016. At the peak of trade, in 2018, Iran sold 620,000 barrels of oil per day to India, worth almost $48 million per day. Iran also relied on India for gasoline because it had limited refining capabilities. For New Delhi, the terms offered by Tehran — shipping discounts, payment deferred for 60 days, and free insurance — were more favorable than from any other nation. The incentives were attractive because India imports more than 80 percent of its energy.

The Trump Administration re-imposed sanctions in November 2018, but offered India a six-month waiver to wind down trade and find alternative sources. As of May 2019, India would face U.S. sanctions if it continued importing Iranian oil. By April 2019, Iran sold only 277,600 barrels per day to India, worth nearly $20 million per day. On May 23, the Indian ambassador to the United States announced that sales had ceased. “We do understand that this has been a priority for the U.S. administration, although it comes at a cost to us because we really need to find alternative sources of energy,” Ambassador Harsh Vardhan Shringla told reporters in Washington.

History and Scope

Persia, as Iran was known until the 20th century, has engaged in commerce with India since antiquity. Oil became part of the commercial relationship after the British discovered oilfields in southwestern Iran in 1908. The British-owned Anglo-Iranian Oil Company became a major energy supplier to the British Empire, which included India until 1947.

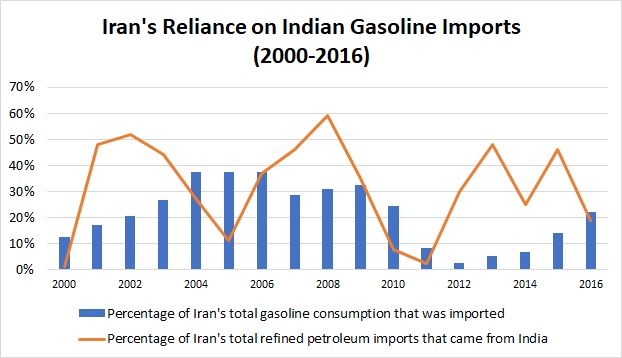

After the early 1960s, records show that Iran earned tens or hundreds of millions of dollars annually by selling crude oil to India. Iran, in turn, relied on India after 2001 to meet domestic energy needs by importing gasoline from Indian refineries. Iran has historically failed to produce enough gasoline, especially as its population doubled after the 1979 revolution. India was willing to sell Iran gasoline even when international sanctions kept other international suppliers away. Iran bought as much as 59 percent of its annual refined petroleum imports from India during sanctions in 2008. Between 2012 and 2016, Iran purchased between 19 percent and 48 percent of its imports from India.

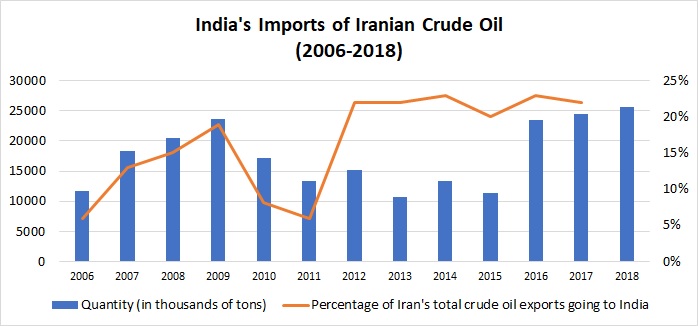

India, which was not even among Iran’s top 20 crude oil importers in 2005, became its third largest in 2006 after sanctions by the United States and the European Union led foreign oil companies to reduce their Iranian imports. Meanwhile, the Indian economy had grown rapidly since the 1990s. Tehran needed new customers, and New Delhi had a growing appetite for oil. India imported Iranian crude by using Indian rupees and euros that would avoid dollar transactions.

Data sources: International Energy Agency and Observatory of Economic Complexity

After the 2015 nuclear deal between Iran and the world’s six major powers, international sanctions were lifted. By 2018, New Delhi’s imports had soared to 620,000 barrels per day. When U.S. sanctions were re-imposed in November 2018, India obtained one six-month waiver to buy Iranian oil at a reduced rate of 300,000 barrels per day.

During periods of international sanctions, the oil trade also bolstered non-oil commerce between the two nations, mostly to the benefit of Indian exporters. New Delhi deposited rupee payments in an Indian bank account that Tehran could use to buy Indian products; the arrangement ensured that Iran was a captive market for annual exports worth $2.5 billion of Indian goods, such as sugar, rice and tea.

Data sources: Indian Ministry of Commerce & Industry and Observatory of Economic Complexity (*Percentage data not yet available for 2018)

Diplomatic Ties

India and Iran did not cut diplomatic relations or dialogue, even after India stopped importing Iranian oil. India’s ambassador in Washington called Iran an “extended neighbor” that shares longstanding cultural ties. Indian leaders welcomed Iranian Foreign Minister Mohammad Javad Zarif in New Delhi on May 14, in the midst of escalating U.S.-Iran tensions. "India is one of our most important partners, economic, political, and regional," Zarif said shortly before his visit.

Tehran and New Delhi also have a shared interest in the port of Chabahar. As of early 2019, India had invested at least $150 million — out of a $500 million commitment — to develop the port on the Gulf of Oman. For Iran, Chabahar is an important deep-water shipping alternative beyond the narrow Strait of Hormuz. For India, the port will provide a trade route to Afghanistan and Central Asia that bypasses Pakistan. As of June 2019, Chabahar was still exempt from U.S. sanctions because Washington viewed it as an economic lifeline for the beleaguered Afghan government. Indian investment in the port has nonetheless stalled since 2017, largely because private Indian firms have been wary of violating U.S. sanctions despite the Chabahar exemption

The Alternatives

Without Indian oil imports, Iran’s main option may be China. China was also a major importer of Iranian oil between 2006 and 2016. Beijing has signaled that it might not comply with U.S. sanctions. On May 17, Iranian Foreign Minister Mohammad Javad Zarif traveled to China. “The Chinese side is willing to, together with the Iranian side, eliminate the interference of complex factors to fully implement the JCPOA,” the Chinese Foreign Ministry said after the meeting. A day earlier, a tanker had unloaded a smuggled shipment of Iranian oil at a Chinese port.

Tehran also declared itself self-sufficient in gasoline after it completed the Persian Gulf Star Refinery in February 2019. In the past, however, rising demand has overtaken newly-built capacity and forced Iran to import more gasoline.

In final 2 days of Asia tour—Turkmenistan, India, China & Japan—fruitful discussions w/ FM Kono & PM Abe in Tokyo, & FM Wang Yi in Beijing. Int'l community, #JCPOA members, & our partners must step up efforts to restore stability & save JCPOA through concrete economic measures. pic.twitter.com/pXwFZb9h7s

— Javad Zarif (@JZarif) May 17, 2019

India turned to Iran’s rivals in the Gulf. In May 2019, two major Indian state refineries signed deals with Saudi Aramco to make up the energy shortfall. India already bought roughly a third of its oil from the Gulf sheikhdoms. Indian refineries have also considered importing more oil from the United States and Mexico.

John Prentice Caves III is a research assistant at the U.S. Institute of Peace.