The following is testimony by Under Secretary of the Treasury for Terrorism and Financial Intelligence David S. Cohen before the Senate Committee on Banking, Housing, and Urban Affairs on Oct. 13, 2011:

Chairman Johnson, Ranking Member Shelby, and distinguished members of the Committee: Thank you for the opportunity to appear before you today to discuss the Department of the Treasury’s contribution to the Obama Administration’s integrated strategy to address the threat posed by Iran’s nuclear program and its extensive support for terrorism.I am pleased to be here with Under Secretary Sherman and Assistant Secretary Mills, as the approach the Administration has taken, and the progress we have achieved, have been marked by a robust, interagency collaboration to confront the threat we face from Iran.

I will focus my remarks today on our sanctions strategy, paying particular attention to the Treasury Department’s vigorous implementation of the Comprehensive Iran Sanctions, Accountability, and Divestment Act (CISADA), the impact CISADA and other sanctions are having on Iran, and our plans to increase the pressure on Iran going forward.

Iran Sanctions Strategy

The Treasury Department’s sanctions efforts are embedded in the dual-track strategy that the United States and our allies are pursuing to address Iran’s continued failure to meet its international obligations regarding its nuclear program.

Notwithstanding the sincere offer of engagement extended to the Iranian government by the United States since the outset of this Administration, Iran has refused to respond meaningfully.In order to compel Iran to change its approach and to make clear to Iran the consequences of its existing approach, the United States is implementing a broad-based pressure strategy.One of the most important elements of which are targeted financial measures designed both to disrupt Iran’s illicit activity and to protect the international financial sector from Iran’s abuse.Our actions have focused on key government entities involved in Iran’s illicit conduct, including nearly two dozen Iranian state-owned banks; the Islamic Revolutionary Guard Corps (IRGC) and its external arm, the IRGC-Qods Force; and, Iran’s national maritime carrier, the Islamic Republic of Iran Shipping Lines (IRISL), and its affiliates.

This strategy has yielded significant results. We have imposed costs directly on the entities we sanctioned, and by focusing our efforts on exposing Iranian entities’ illicit and deceptive activities, we have built support among foreign governments to take similar actions.The global private sector also has amplified our actions – often taking voluntary steps beyond their legal requirements – because our actions have highlighted the pervasive nature of Iran’s illicit and deceptive conduct and the reputational risks associated with any Iran-related business.

Our ability to isolate and disrupt the IRGC and designated Iranian financial institutions was strengthened considerably last year when President Obama signed CISADA into law.CISADA has helped us make the case to foreign governments and foreign financial institutions that the IRGC and Iran’s designated banks should not be allowed access to the international financial system.As I will describe in more detail, our implementation of CISADA has significantly impaired designated Iranian banks’ access to the international financial system, impeding their ability to facilitate Iran’s illicit activities, and creating unprecedented financial and commercial isolation for Iran.

Although we are making progress, there is, of course, still much to be done.Iran is feeling the impact of the pressure, but we have yet to achieve the objective of our dual-track strategy:concrete action by Iran to comply with its international obligations and to address the international community’s concerns regarding its nuclear program.

Recent Actions and Progress

Since last May, when I last appeared before this Committee, Treasury has taken a number of significant actions that have increased markedly the pressure on Iran.

Tidewater Middle East Co. and Iran Air

The IRGC continues to be a primary focus of U.S. and international sanctions against Iran because of the central role it plays in all forms of Iran’s illicit conduct, including Iran’s nuclear and ballistic missiles programs, its support for terrorism, and its involvement in serious human rights abuses.As Iran’s isolation has increased, the IRGC has expanded its reach into critical sectors of Iran’s economy, displacing ordinary Iranians, generating revenue for the IRGC and conducting business in support of Iran’s illicit activities.We previously imposed sanctions on several IRGC-related entities, and in June we continued the effort to expose the IRGC’s expansive economic reach – this time, into Iran’s maritime and transportation sectors.

Using our nonproliferation authorities, in June, we designated Tidewater Middle East Co. (Tidewater), an IRGC-owned port operating company that manages the main container terminal at Bandar Abbas and has operations at six other Iranian ports.The Bandar Abbas port handles approximately 90 percent of Iran’s containerized shipping traffic and has been used by Iran to export arms and related materiel in violation of several United Nations Security Council Resolutions (UNSCRs).That same day, we also imposed sanctions against Iran Air, the Iranian national airline carrier, because it has been used by the IRGC and Iran’s Ministry of Defense for Armed Forces Logistics (MODAFL) to transport military-related equipment.

The international private sector responded swiftly to these actions, taking steps to ensure that they have no part in dealing with these proliferators. For example, several of the world’s largest shipping container firms, Maersk, Hapag Lloyd, and NYK Lines, have stopped calling at Bandar Abbas’ Shahid Rejaie terminal and have stopped or will stop all shipments of Iran-bound cargo.

IRISL

Since IRISL was designated by the U.S. in 2008, the UK in 2009, and the EU in 2010 for supporting Iran’s WMD proliferation activities, it has sought to evade sanctions by changing ships’ names and nominal owners – often multiples times – and altering shipping documents to disguise its activities.Treasury, in turn, continues to expose IRISL’s use of these and other deceptive practices and has imposed sanctions on more than 150 IRISL-related vessels, companies, entities and persons over the last three years.

In June, we added to this list by designating 10 IRISL front companies, as well as three individuals who each play a key role in aiding IRISL’s sanctions evasion activities worldwide.

Our actions, coupled with similar sanctions imposed by many of our partners around the world, have substantially hindered IRISL’s operations, causing it real financial distress.Because of sanctions imposed by the EU, IRISL today is largely shut out of European ports.It is also unable to obtain maritime insurance from any of the world’s recognized insurers, including the Lloyd’s market.Instead, IRISL is now insured, if at all, by a sanctioned Iranian insurance company with no history of writing maritime insurance and no track record of paying maritime claims.Along with this change in insurance, which in some cases has run contrary to the terms of IRISL’s vessel mortgages, IRISL has had difficulty making payments on its mortgages.This has led to about a half-dozen IRISL ships being arrested in ports around the world by creditors seeking payment.

Iranian Human Rights Abuses

In response to the Iranian regime’s serious human rights abuses, CISADA required that the President impose sanctions upon Iranian officials, or persons acting on behalf of the Iranian Government, who are responsible for or complicit in the commission of serious human rights abuses against Iranians.In September 2010, President Obama signed E.O. 13553, which authorizes Treasury, in consultation with the State Department, to expose serious human rights abuses by the Iranian regime, both inside and outside of Iran.As the regime’s abuse of its citizens’ human rights has continued, together we have imposed sanctions under E.O. 13553 against 11 senior Iranian officials and three Iranian entities – the IRGC, the Basij Resistance Force, and Iran’s Law Enforcement Forces (LEF) – including the IRGC’s commander, the LEF chief, and Iran’s Intelligence Minister.

Treasury actions with State have also exposed Iran’s support of the Syrian government’s ongoing violence and repression of the Syrian people.Under E.O. 13572, which targets those responsible for, complicit in, or providing material support to those engaged in human rights abuses in Syria, Treasury designated the LEF’s Chief and Deputy Chief, and two senior IRGC-Qods Force officers – all for supporting the brutal suppression of the Syrian people orchestrated by Syrian General Intelligence Directorate.

Iranian Support for Terrorism

We have not lost – and must not lose – sight of the fact that Iran is the world’s most active state sponsor of terrorism.Iran has used its state apparatus – including especially the IRGC-Qods Force –to support a wide range of terrorist organizations, including Hizballah, Hamas, Palestinian Islamic Jihad (PIJ), the Popular Front for the Liberation of Palestine-General Command (PFLP-GC) and the Taliban.In addition to providing financial support to these terrorist groups, Iran has allowed al-Qai’da to use its territory for the movement of money, facilitators, and al-Qa’ida operatives.Al-Qa’ida’s core financial pipeline – which runs from Kuwait and Qatar, through Iran, to Pakistan – depends upon an agreement between al-Qa’ida and the Iranian government to allow this network to operate within its borders.In July, Treasury designated six members of this network headed by an Iran-based individual to further degrade al-Qa’ida and expose Iran’s continued support to terrorist groups worldwide.

Financial Sanctions and Implementation of CISADA

The key focus of our efforts remains Iranian banks that either directly facilitate Iran’s WMD and missile proliferation activity, or that provide material support to banks that have been designated for engaging in that activity.These sanctions, coupled with the power of CISADA, have continued to erode designated Iranian banks’ access to financial services, protect the international financial system from risks posed by designated Iranian banks, and impede Iran’s ability to acquire material for its nuclear program.Moreover, because many of Iran’s largest state-owned banks have been sanctioned for engaging in, or supporting other banks engaged in illicit activity, our sanctions – along with complementary actions by many of our allies – have imposed substantial economic pressure on Iran.

In May, we continued these efforts by designating Iran’s Bank of Industry and Mine (BIM) under E.O. 13382 for providing financial services to other designated Iranian banks. After the EU acted to implement UNSCR 1929 by prohibiting 18 Iranian banks from conducting transactions in Europe, BIM used one of its accounts as a conduit for transactions into Europe by designated banks, including Bank Mellat and Bank Saderat.That is, BIM, like Post Bank before it, engaged in a scheme to front for designated banks in an effort to evade U.S. sanctions. BIM is the22nd Iranian state-owned financial institution to be designated by Treasury.

CISADA’s powerful new financial authorities have amplified the impact of our designations of Iranian banks.Under CISADA, the Secretary of the Treasury is empowered to cut off from the U.S. financial system any foreign bank that facilitates the activity of individuals and entities sanctioned by the UN Security Council in its recent Iran resolutions, as well as any foreign financial institution that facilitates a significant transaction, or provides significant financial services, for any Iranian bank designated by the U.S. or for the IRGC and any of its designated agents or affiliates.

Since President Obama signed CISADA into law, my colleagues in the Treasury Department and I have aggressively implemented it in close coordination with the State Department.We issued the Iran Financial Transaction Regulations just over a month after the law was passed, describing in detail the activity that could lead to action by the Treasury Department against a foreign financial institution.And we have embarked on a worldwide tour to spread the word of the serious consequences that could befall a financial institution that engages in CISADA-sanctionable activity.This has involved outreach to foreign financial institutions, regulators, and government agencies in nearly 50 countries across five continents.Just two weeks ago, for instance, I traveled to China to speak with government officials in Beijing and Hong Kong, and with the private sector in Hong Kong, about CISADA.

As we explain in these engagements, CISADA offers a clear choice: a foreign financial institution can have access the largest and most important financial sector in the world – the United States – or it can do business with the IRGC or Iranian banks sanctioned for facilitating Iran’s illicit activity, but it cannot do both.For the overwhelming majority of foreign banks, the choice has been a simple one, and those that had potentially sanctionable relationships discontinued that business.The result is exactly what Congress intended: CISADA has helped us deepen and broaden Iran’s isolation from the international financial system.

We continue to be vigilant to uncover and investigate activity that may lead to action under CISADA.And we remain ready and willing to utilize the tools provided by CISADA whenever and wherever necessary.

The Impact of Sanctions on Iran

Last December, in testimony to the House of Representatives Committee on Foreign Affairs, my predecessor described the impact of sanctions on Iran this way:“Iran has become increasingly isolated from the international financial system, with limited access to financial services….Iran has been relegated to the margins of the international financial system, and is finding it increasingly difficult to access the large-scale, sophisticated financial services necessary to run a modern economy efficiently.”I can report that Iran’s financial isolation, and the economic impact of that isolation, have both continued to grow.

Due to a combination of factors – including UNSCR 1929, financial sanctions imposed by the U.S., EU, and other like-minded countries, and foreign banks’ interest in avoiding CISADA actions or the reputational risk of doing business with Iran – the number and quality of foreign banks willing to transact with designated Iranian financial institutions has dropped precipitously over the last year.Iran’s shrinking access to financial services and trade finance has made it extremely difficult for Iran to attract foreign investment, pay for imports, or receive payment for exports.This has led to a number of significant macroeconomic effects in Iran, exacerbating persistent economic weakness due to the Iranian government’s mismanagement of its economy.

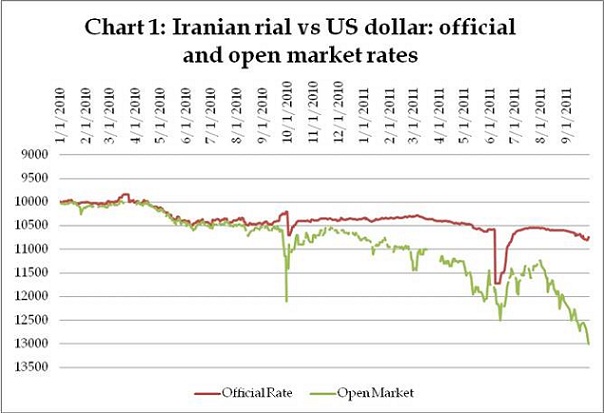

Sanctions have increased the cost and difficulty of accessing adequate foreign exchange, including the dollar, which has contributed to major instabilities in Iran’s currency. (See chart 1) Last fall, following the adoption of UNSCR 1929 and various member states’ actions to implement the Resolution, the spread between the official and the private-market exchange rates for the Iranian rial widened dramatically.In September 2010, the rial depreciated by up to 20 percent in one week alone.It recovered, but earlier this year, the spread between the official and the market exchange rate again began to widen.Iran’s Central Bank intervened in early June, devaluing the rial by 11 percent in an effort to close the gap, but it has only grown wider since.The Central Bank of Iran has so far been unable to contain volatility in the rial market exchange rate.There are a number of theories to explain this phenomenon, but it is surely driven by Iranians seeking to convert their rial into foreign currency, underscoring the extent to which Iranians lack confidence in their economy.

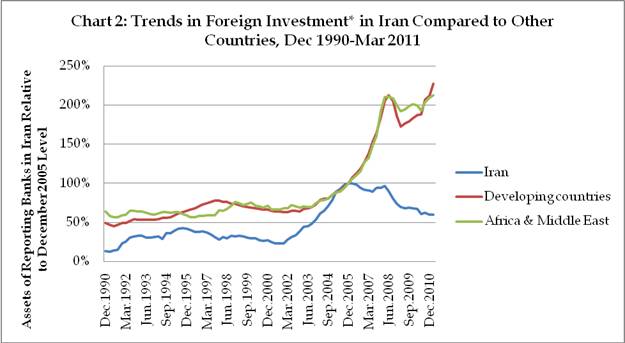

Dwindling direct foreign investment in Iran also reflects, in part, the impact of our targeted sanctions.At a time when Iran could badly use an infusion of international capital, foreign investment in Iran remains low in comparison to other developing economies. (See chart 2)

The International Monetary Fund has attributed this trend to international sanctions and Iran’s difficult business environment.Iran continues to struggle to attract investment in key sectors, particularly oil and gas.Many international and national oil companies have effectively withdrawn from Iran, depriving the country of large-scale foreign investments and technology.As a result, the International Energy Agency projects that Iranian oil production will decline by about 800,000 barrels per day (bpd) by 2016, a roughly 20 percent decline in production capacity.At current oil prices, such a decline will cost Iran on average about $14 billion (about 3 percent of Iran’s GDP) in annual oil revenues through 2016.

Sanctions have also led to the IRGC taking over key aspects of Iran’s economy, exacerbating the cronyism and corruption that pervades the Iranian regime.We have seen this in a number of areas.Khatam al-Anbiya, the U.S.-, EU-, and UNSC-designated engineering arm of the IRGC, has been recruited to develop key energy resources.The IRGC, through its sanctioned affiliates Bonyad Tavon Sepah and Mehr Bank, took over Tidewater, a port operator that until a few years ago had been privately owned.And President Ahmadinejad recently appointed Rostam Ghasemi, a U.S. and EU-designated IRGC commander and former leader of Khatam al-Anbiya, as Minister of Oil.This appointment was applauded by the IRGC, which characterized Ghasemi’s new role as a “meaningful and critical response to the attacks against the guards from the west’s media empire.”However, even members of Iran’s government have publicly questioned the wisdom of this decision.One member of Iran’s parliament observed that “the integration of the guard, as a military force, in political and economic power is not in the interests of the system…. In neighboring countries, military officials are distancing themselves from politics and power, while it’s the opposite in Iran.”Furthermore, the inclusion of the IRGC throughout the Iranian economy has opened up Iran to greater pressure through sanctions.

Altogether, there is little doubt that our sanctions strategy has markedly reduced Iran’s access to the international financial system and, consequently, has contributed to a noticeable weakening in the Iranian economy.

The Continuing Threat and the Way Forward

The Governor of the Central Bank of Iran, Mahmoud Bahmani, commenting on the financial sanctions, said recently that Iran should “fight back, and that’s for sure,” asking, “But how?”It is clear that Iran has chosen to “fight back” against sanctions by using increasingly deceptive tactics in an effort to evade the scrutiny of governments, regulators, and banks around the world.As Iran has lost access to global banking and financial services, and suffered disruptions in its ability to conduct trade worldwide, Iran is trying to preserve the limited access its designated banks have to the international financial system while simultaneously seeking to secretly establish new footholds.To do so, Iran is targeting vulnerable jurisdictions and financial institutions that may willingly or unwittingly allow designated Iranian banks to operate.

For example, some branches and subsidiaries of designated Iranian banks continue to operate in jurisdictions outside of Iran.Although many foreign banks would prefer not to do business with these branches and subsidiaries, Iranian bank branches exploit legal systems that allow them to continue to operate, jeopardizing the integrity of their host countries’ financial sectors.We have been working with these host countries to shut down the operations of overseas affiliates of designated Iranian banks.We have achieved some success, but there is more work to do.

We also know that Iran has attempted to purchase banks in other countries, relying upon third-party associates or firms to facilitate these purchases in order to mask Iranian involvement and ownership.Preventing these attempts to circumvent multilateral sanctions remains a key focus of our strategy.Where we have information about these potential purchases, we work to alert our foreign partners and urge them to prevent Iran from gaining access to their financial sector in this manner.

We are also continuing our intense efforts to implement CISADA.Last week, we issued a final rule to implement Section 104(e) of CISADA, establishing a reporting requirement for U.S. banks that will complement our efforts to identify CISADA-sanctionable activity by foreign banks.We have already begun to utilize this regulation by issuing this week information requests to a number of U.S. banks regarding several foreign banks that we have reason to believe may be involved in activity sanctionable under CISADA. If we become aware of possible CISADA violations – through this or other investigative efforts under way – we will seek prompt resolution, either by insisting on confirmation from the foreign bank that it has ended its relationship with designated Iranian banks or by imposing CISADA sanctions.

As more and more countries and foreign banks refuse to deal with designated Iranian banks, we also remain keenly focused on the possibility that non-designated Iranian financial institutions may become involved in proliferation activity or terrorist financing, or may begin to provide material support to banks that are designated for doing so.And we continue to consider the case of the Central Bank of Iran (CBI).At this time, because of our country-wide sanctions program, U.S. financial institutions are already generally prohibited, with only limited exceptions, from doing business with any bank in Iran, including the CBI.Treasury has also consistently communicated to our foreign partners the risks of doing business with the CBI, as highlighted in UNSCR 1929.Further U.S. action against CBI, if it engenders multilateral support, could further isolate the CBI.I can assure the Committee that the Administration will continue to carefully weigh the legal bases and policy ramifications of further action against the CBI, and we are committed to continuing to work with the Congress on this crucially important issue.

Conclusion

As Iran continues to choose the path of defiance, Treasury, working with our colleagues across the Administration and in Congress, will continue to develop new and innovative ways to impose additional costs on Iran to create crucial leverage for our diplomacy.I look forward to continuing our work with this Committee as Treasury continues to pursue this important strategic objective.