Bijan Khajehpour

After taking over the presidential office in early August, President-elect Hassan Rouhani will face a long host of economic challenges. He has made the economy—especially tackling unemployment—his highest priority, but it is clear that the process of reversing the negative trends of the past few years will be a medium-term process.

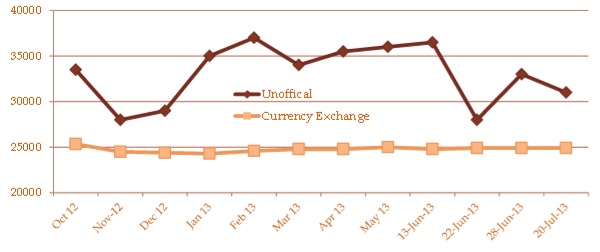

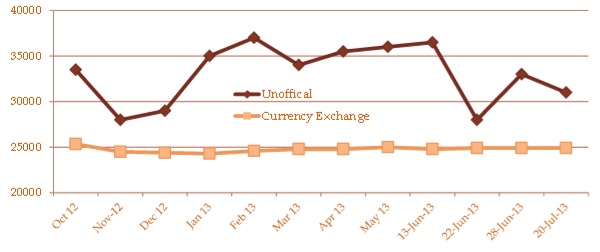

Incidentally, the country’s key economic stakeholders, especially the business community, have reacted very positively to Rouhani’s election. The free market rate of the Iranian rial gained about 20 percent in value between June 14 and 22, and then it bounced back (see graph below). The reason for the rebound was the fact that a price of 32,000 rial to the U.S. dollar is quite realistic. Experts agree that Rouhani’s trump card will be to return the technocrats from the previous governments to the fore. However, the road to recovery will be long.

Economic and Petroleum Sector Challenges

The Iranian economy has been battered by the poor performance of the Ahmadinejad government. Today the economy, especially the petroleum sector, which has been an engine for the Iranian economy, is facing major issues. The new president will have to deal with several serious challenges. The complete list would be very long, but the most significant challenges are:

• High inflation: Subsidy reforms, mismanagement, and the collapse of the rial have generated an inflationary economy that is eating away the average citizen’s purchasing power;

• Unemployment: With an overall unemployment rate of about 13 percent and a youth unemployment rate as high as 27 percent, Iran is facing a major socio-economic issue;

• Lack of investor confidence: Mismanagement and corruption alongside political uncertainties and favoritism among semi-governmental organizations have all contributed to a business environment in which private sector investors are very hesitant to invest. The consequence is lack of capital formation and jobs in the economy;

• Sanctions: Iran’s economy as a whole, and particularly the petroleum industry, has been undermined by external sanctions. This has created numerous problems for the country’s economy like declining oil revenues;

• Subsidy reforms: The next government will have to find ways to make the ongoing subsidy reforms more efficient for the economy as a whole. So far the reforms have had major inflationary impacts and negative consequences for the local industry;

• Lack of investment and technology in the petroleum sector: As a direct result of external sanctions, Iran has been deprived of the needed capital and technology in its petroleum sector;

• Collapse of the domestic industry: Misplaced trade policies as well as subsidy reforms have put a lot of pressure on the domestic industry. Though the recent devaluation of the rial has made the Iranian industry more competitive again, it will take time for the local industry to regain their lost financial and technical strength;

• Brain drain: The undesirable conditions of the past few years have led to a growing brain drain in the economy. This will be significant in specialized industries such as petroleum, but it will generally be an issue that the next government will have to attend to;

• Lack of professionalism: The Ahmadinejad government’s policies in awarding projects to its own trusted circles has led to a disastrous level of unprofessional behaviors in project management and project quality and a weakening of the more professional subcontractors in the country.

Rouhani’s Approach

Hassan Rouhani has stated clearly that Iran’s economic issues are mainly caused by poor management and society’s lack of confidence in government institutions. He also believes that sanctions and international tensions have resulted in economic deterioration, inflation, and frustration. The consequence of all these shortcomings has been a loss in purchasing power of the average Iranian family and subsequent economic hardship.

During his campaign and also in interviews after his victory, he has favored actions that can contribute to a sense of stability in the economy. He also wants to achieve higher living standards by: a) creation of national wealth and b) fair distribution of national wealth.

His other economic pledges are:

• Giving more independence to the Central Bank of Iran;

• Reviving the Management and Planning Organization that Ahmadinejad dissolved in 2005;

• Offering short-term and long-term solutions to issues such as inflation, unemployment, housing, cash subsidies, and healthcare;

• Empowering domestic production;

• Improving the business and regulatory environment.

Potential Economic Policies

Rouhani’s top economic advisor, Mohamad Baqer Nobakht, has provided some insight into the next government’s priorities in the field of economic management. These include:

• Looking for initiatives to secure sanctions relief to reduce their negative impact on the economy of Iran. Rouhani was Iran’s nuclear negotiator between 2003 and 2005, and he is familiar with the complexities of the Iranian nuclear negotiations. His first goal will be to make sure that there are no new sanctions, followed by what he calls “increased transparency” in order to secure sanctions relief.

• Redefining the redistribution of cash generated through subsidy reforms. The Rouhani government intends to discontinue cash handout payments to higher income groups in order to be able to increase cash payments to lower income classes. In the words of Nobakht: “The real need of the rich is not cash subsidies but they need protection for their investments.”

• Supporting the local industry, not just manufacturing, but also investing in larger agricultural production, promotion of tourism, etc.

• Immediately implementing the “Law for the Continuous Improvement of Business Climate,” which had been passed by the Majles but was then ignored by the Ahmadinejad government. The law foresees the lowering of the government’s role in the economy, the empowerment of the non-governmental sector, investment guarantees, etc., which will all be meant to restore some investor confidence in the economy.

Outlook and Conclusions

Experts agree that the Iranian economy will initially benefit from the change of government and the associated positive momentum. However, restoring economic normalcy and a return to medium-growth scenarios will require time—potentially three to four years.

High inflation is likely to persist in the following years due to subsidy reforms and the delayed impact of the rial devaluation. The average inflation rate will fall moderately to about 27 percent in 2013 and move toward 20 percent in 2014. The outlook for economic growth will depend on the outcome of the nuclear negotiations and the future of sanctions.

The value of the rial against the U.S. dollar will consolidate around 32,000 rial to one USD in 2013, but will fall further due to inflationary effects. There will also be a positive impact on job creation due to the new government’s attention to private sector activity. However, unemployment figures will not drop significantly due to the negative impacts of demography, subsidy reforms, and privatization.

All in all, the election of Rouhani has the potential of reversing the negative economic developments of the past few years. Iran is moving toward a more pragmatic set of policies, but it will take time to return the economy to a degree of normalcy.

Rouhani’s main focus will be the economy and here the return of the old technocrats will generate a positive momentum. A more creative and de-escalating approach to the nuclear negotiations could pave the way for some degree of sanctions relief and also a growing presence of foreign companies in the market.

One of the significant moves by Hassan Rouhani has been the inclusion of Mohammad Nahavandian, the president of the Iran Chamber of Commerce, in the new cabinet, which will facilitate the promotion of private sector activity. Nonetheless, the Iranian economy will have to continue to deal with high inflation, but a degree of sustainability in government policy as well as legal reforms could improve the overall business environment.

This piece was first published as Viewpoints 33 by the Middle East Program at the Woodrow Wilson Center for International Scholars.

Bijan Khajehpour is a managing partner at Atieh International.