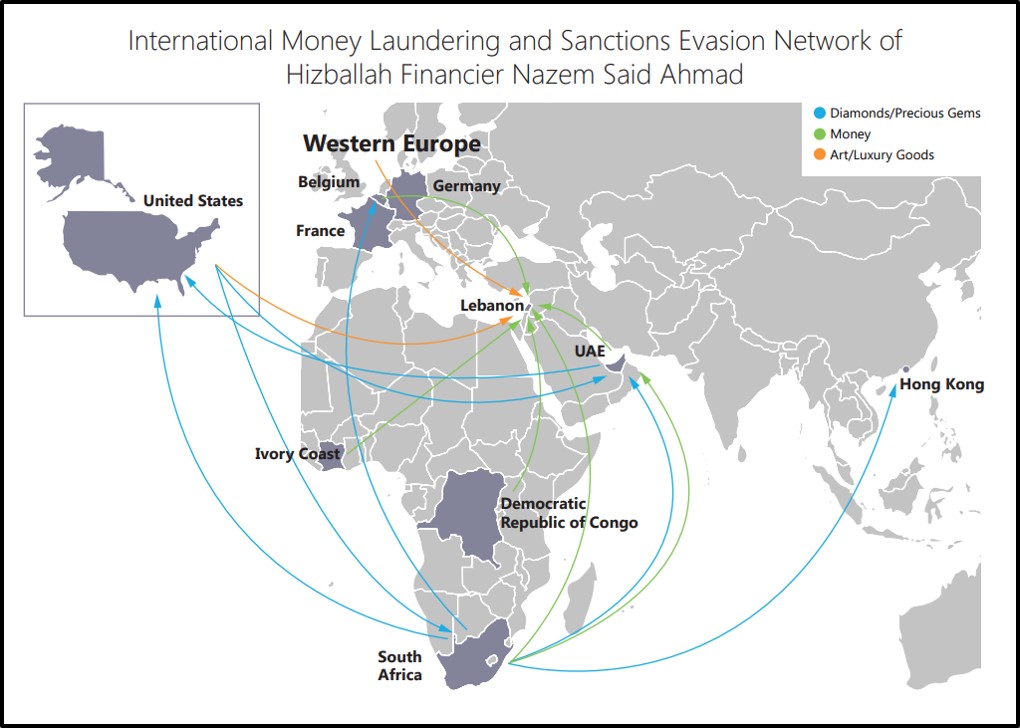

On April 18, the United States sanctioned 52 people and companies based in nine countries for assisting Nazem Said Ahmad, a financier for Hezbollah, a Lebanese militia and political party backed by Iran. The list included six members of Ahmad’s family, 14 associates, and 32 companies. They laundered money and evaded U.S. sanctions for Ahmad, who was designated a terrorist by the United States in 2019. The designations, in coordination with Britain, reflected concern over Hezbollah’s ability to fund international terrorist activities, many of which have been coordinated with Iran.

The network—based in Britain, Belgium, Hong Kong, Lebanon, the United Arab Emirates, South Africa, Angola, Côte d’Ivoire, and the Democratic Republic of the Congo, Belgium—facilitated the “payment, shipment, and delivery of cash, diamonds, precious gems, art, and luxury goods” for Ahmad, a Treasury Department statement said. Secretary of State Antony Blinken vowed that the United States would “continue to hold accountable those who would seek to harm the United States and our partners.” The U.S. sanctions were imposed under Executive Order 13382, issued in September 2001, which applied to entities accused of supporting terrorism.

The State Department also announced a $10 million reward for information on Ahmad to disrupt Hezbollah finances. And the Justice Department charged Ahmad and eight others for conspiring to defraud the U.S. and other governments, evading sanctions, and money laundering. Seven of the eight co-conspirators were also designated by the Treasury. One defendant was arrested in Britain, but the others remained at large.

Britain sanctioned Ahmad and froze all of his assets in the United Kingdom. The move prohibited transactions with the Hezbollah financier. It also blocked Ahmad from the British art market and barred dealers from business with him and any linked companies.

The coordinated move by several U.S. departments and Britain came on the 40th anniversary of U.S. Embassy Beirut bombing by Hezbollah, which killed 63 people and was allegedly financed by Iran. “The United States maintains its resolve to pursue justice for the victims and remains vigilant in the global fight against terrorism,” Secretary of State Antony Blinken said in a statement commemorating the anniversary. “We continue to work actively in Beirut with the Lebanese people in support of a stronger, more secure, and more prosperous Lebanon.” The following are statements from the State, Treasury, and Justice Departments as well as Britain.

Secretary of State Antony Blinken

In a statement on the sanctions: “Today, the Department of State and the Department of Treasury are taking actions against a global sanctions evasion network that facilitates the payment, shipment, and delivery of cash, art, and luxury goods for the benefit of Hizballah financier and Specially Designated Global Terrorist Nazem Said Ahmad. The Treasury Department is designating this network and the State Department is re-advertising its reward offer of up to $10 million for information on Hizballah’s financial mechanisms, including Ahmad.

In a statement on the sanctions: “Today, the Department of State and the Department of Treasury are taking actions against a global sanctions evasion network that facilitates the payment, shipment, and delivery of cash, art, and luxury goods for the benefit of Hizballah financier and Specially Designated Global Terrorist Nazem Said Ahmad. The Treasury Department is designating this network and the State Department is re-advertising its reward offer of up to $10 million for information on Hizballah’s financial mechanisms, including Ahmad.

“These actions are being coordinated among the Departments of State, the Treasury, Justice, Homeland Security, and Commerce, as well as with the United Kingdom, to target on elements of the network. Today’s actions highlight the tactics used by sanctions evaders, trade-based money launderers, and supporters of terrorism, as well as the risks of conducting business in permissive industries, such as the art, diamond, and precious gems markets. We will continue to hold accountable those who would seek to harm the United States and our partners.”

In a statement on the 40th anniversary of the U.S. Embassy Beirut bombing: “Today, we remember the victims of a heinous terrorist attack at the U.S. Embassy in Beirut forty years ago, killing 63 people. We stand with the families, friends, and colleagues of those whose lives were cut short.

“Despite Hizballah’s efforts to use terror to drive a wedge between the United States and the Lebanese people, our close cooperation has only deepened in the 40 years since this reprehensible attack.

“The United States maintains its resolve to pursue justice for the victims and remains vigilant in the global fight against terrorism. We continue to work actively in Beirut with the Lebanese people in support of a stronger, more secure, and more prosperous Lebanon.”

Treasury Department

“Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated a vast international money laundering and sanctions evasion network of 52 individuals and entities in Lebanon, the United Arab Emirates, South Africa, Angola, Côte d’Ivoire, the Democratic Republic of the Congo, Belgium, the United Kingdom, and Hong Kong. This network facilitated the payment, shipment, and delivery of cash, diamonds, precious gems, art, and luxury goods for the benefit of Hizballah financier and Specially Designated Global Terrorist Nazem Said Ahmad, who was designated on December 13, 2019, for providing material support to Hizballah. The network designated today includes dozens of individuals and their associated companies involved in assisting Nazem Said Ahmad in evading U.S. sanctions to maintain his ability to finance Hizballah and his luxurious lifestyle. This designation is a part of a coordinated action with the Department of Homeland Security, the Department of State’s Rewards for Justice program, and the United Kingdom.

“Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated a vast international money laundering and sanctions evasion network of 52 individuals and entities in Lebanon, the United Arab Emirates, South Africa, Angola, Côte d’Ivoire, the Democratic Republic of the Congo, Belgium, the United Kingdom, and Hong Kong. This network facilitated the payment, shipment, and delivery of cash, diamonds, precious gems, art, and luxury goods for the benefit of Hizballah financier and Specially Designated Global Terrorist Nazem Said Ahmad, who was designated on December 13, 2019, for providing material support to Hizballah. The network designated today includes dozens of individuals and their associated companies involved in assisting Nazem Said Ahmad in evading U.S. sanctions to maintain his ability to finance Hizballah and his luxurious lifestyle. This designation is a part of a coordinated action with the Department of Homeland Security, the Department of State’s Rewards for Justice program, and the United Kingdom.

“'The individuals involved in this network used shell companies and fraudulent schemes to disguise Nazem Said Ahmad’s role in financial transactions,' said Under Secretary of the Treasury for Terrorism and Financial Intelligence Brian E. Nelson. 'Luxury good market participants should be attentive to these potential tactics and schemes, which allow terrorist financiers, money launderers, and sanctions evaders to launder illicit proceeds through the purchase and consignment of luxury goods.'

“Treasury has documented the money laundering and terrorist financing risks associated with the trade of works of art in its February 2022 report titled “Study of the Facilitation of Money Laundering and Terror Finance Through the Trade of Works of Art” and the October 2020 OFAC Art Advisory.

“OFAC is designating this complex network of family members, business associates, and companies under Executive Order (E.O.) 13224, as amended, which targets terrorists, terrorist organizations, leaders, and officials of terrorist groups, and those providing support to terrorists or acts of terrorism.

A GLOBAL NETWORK

“With operations in Beirut, Lebanon; Dubai, United Arab Emirates; Johannesburg, South Africa; and Hong Kong, Nazem Said Ahmad directs a global network of family members, associates, and companies that take advantage of the permissive nature of the global diamond, precious gems, and art market to facilitate payment for, and shipment and delivery of, luxury goods. The network utilizes legal and illegal arrangements to coerce both witting and unwitting participants into falsely engineering certificates, which are required under the Kimberley Process, to manipulate diamond prices and taxes, and to give their business the appearance of legitimacy. The network also uses aliases, front companies, and fraudulent paperwork to enable Nazem Said Ahmad to purchase or consign high-priced luxury goods and artwork from auction houses and galleries worldwide. The network undervalued invoices for imported goods and cleared bulk items through seaports, leveraging Hizballah’s influence at these ports of entry to move assets into Lebanon without paying the applicable taxes and duties.

“Nazem Said Ahmad eludes safeguards within the U.S. and international financial system by using associates and front companies that transact on his behalf, while also clandestinely storing large amounts of currency outside the reach of Lebanese banking officials and regulators. To circumvent cash reserve restrictions set by central banking authorities and avoid scrutiny by the Lebanese and international banking communities, the network facilitated a complex scheme of bulk cash transfers, intra-network accounting book transfers, and payments from personal bank accounts and credit cards for business transactions. Nazem Said Ahmad’s associates, along with their legitimate and illegitimate businesses, played an important role in the overall scheme by engaging in “layering,” the name used for the stage in a money laundering operation that disconnects proceeds from the nefarious activity that generated them. Trusted couriers transported cash and other tangible assets, such as diamonds and art, for the financial benefit of Nazem Said Ahmad, his family, and his close associates.

“The luxury goods and art market has been an ideal avenue for Nazem Said Ahmad and his co-conspirators to move funds out of Lebanon, capitalizing on schemes to overvalue and undervalue artwork and Nazem Said Ahmad’s background as an experienced collector to exploit the industry’s practices. Since 2012, Nazem Said Ahmad has acquired over $54 million in works of art from major auction houses, galleries, and exhibitions, or even directly from artists’ studios, often concealing his beneficial ownership by having official invoices drawn up using cover companies, family members, or business associates as the owners.

KEY FACILITATORS AND ASSOCIATES

“Nazem Said Ahmad’s Family Members

“Firas Ahmad, Nazem Said Ahmad’s son, handles many of his father’s business affairs in South Africa. Firas Ahmad is the director of South Africa-based diamond company Mega Gems (PTY) LTD (Mega Gems) and controls another diamond company, Thula Uzwe Trading, also in South Africa.

“Firas Ahmad obfuscated his ultimate beneficial ownership of Mega Gems through a front company, Oriental Dynasty Limited, directed by his wife, Rim Nasser, who acted as a nominee shareholder. Concealment of his ultimate beneficial ownership is a common tactic used by Nazem Said Ahmad, which his children have also adopted to insulate themselves from legal scrutiny and assist in sanctions evasion schemes on behalf of their father.

“Since 2018, Nazem Said Ahmad’s daughter, Hind Ahmad, has brokered deals on behalf of her father, as well as coordinating the creation of an alias to help her father evade sanctions and purchase artwork from U.S. companies. Hind Ahmad also acted as a broker for the sale of art in the ultimate beneficial interest of her father, including approaching witting and unwitting studios and galleries to change the provenance line of certain pieces to make their onward sale more attractive to prospective buyers. Hind Ahmad directly owns and operates two galleries, Artual Gallery in Beirut, Lebanon and DIDA in Abidjan, Côte d'Ivoire. She is also indirectly associated with several other galleries but has obfuscated her connections to these entities to insulate them from the impact of her father’s designation.

“Rami Baker, Nazem Said Ahmad’s brother-in-law, is a close friend and business associate who served as a proxy for Nazem Said Ahmad in many companies in Lebanon and Angola. On behalf of Nazem Said Ahmad, Rami Baker is the proxy owner of United Investment Group SAL, a Beirut-based real estate company that develops luxury real estate projects. Rami Baker is also the trustee for the 76 Benmore Gardens Trust that manages the expansive property portfolio owned by the Ahmad family in the Johannesburg area, including the home inhabited by Firas Ahmad, Rim Nasser, and their family. Rami Baker also owns a Romania-based company, Collecting Bee SRL.

“Nazem Said Ahmad’s wife, Rima Baker, served as a proxy for Nazem Said Ahmad for both the purchase as well as the consignment of works of art in his collection. Additionally, the network used her name to circumvent UK anti-money laundering procedures covering art market transactions related to a purchase of a work of art from a London-based gallery in the interest of Nazem Said Ahmad.

“Rima Baker is the majority shareholder of Beirut-based Park Ventures SAL and a Beirut-based real estate company Debbiye 383 SAL. Park Ventures SAL handled the shipping and logistics of importing millions of dollars of art from U.S. and foreign art galleries into Beirut, and circumvented U.S. sanctions through a proxy ownership structure that purposefully registered shares of the company in the names of Rima Baker and Hind Ahmad.

“Hind Ahmad’s husband, French-Senegalese national Da’ud El Riz, facilitated the acquisitions by his wife and conducted personal and professional business transactions for the benefit of his wife and her galleries. Several of these transactions were the subjects of a scheme to undervalue invoices in a manner that would allow the network to circumvent taxes and duties levied on high-value imports by the Lebanese government.

“Nazem Said Ahmad’s Business Associates and Accountants

“Mohamad Hijazi directs Dubai-based White Star DMCC, a front company that was used as the primary financial front for Nazem Said Ahmad to purchase art imported both legally and illegally into Lebanon. Mohamad Hijazi maintained a financial ledger that detailed cash transactions, intra-company book transfers, personal bank account transfers, and credit card transactions, in addition to the use of White Star DMCC’s multiple bank accounts for cross-border payment settlements. Many of the transactions listed in the ledgers recorded the movement of cash to Lebanon for use by Nazem Said Ahmad or remitted to Firas Ahmad or Rami Baker for their personal or business operations. Mohamad Hijazi also coordinated with Hind Ahmad to create an alias to facilitate the purchase of artwork from U.S. companies, and his identification was used to circumvent UK anti-money laundering procedures covering transactions related to the purchase of a work of art from a London-based gallery in the interest of Nazem Said Ahmad.

“Sundar Nagarajan acted as Nazem Said Ahmad’s primary international accountant, providing material support through his management of, and accounting for, businesses in Nazem Said Ahmad’s network. Sundar Nagarajan was the central manager of financial ledgers detailing the network’s operations in Hong Kong, the United Arab Emirates, and South Africa. Sundar Nagarajan also facilitated payment for and shipment of art that Nazem Said Ahmad purchased from major auction houses and galleries.

“In many cases, Nazem Said Ahmad would personally negotiate the purchase of art from artists and galleries via email or messaging on a social media platform. He would then direct Ali Mossalem and Mohamad Ismail, both Beirut-based accountants in Nazem Said Ahmad’s employ, to coordinate all logistics related to the payment of invoices, shipment, and delivery of art, including the customs process at Lebanese ports of entry.

“Mohamad Ismail facilitated the payment, shipment, and delivery of art that Nazem Said Ahmad purchased, including acting as a personal courier to ferry works of art from European galleries to Lebanon. Mohamad Ismail also coordinated the collection of rental income for tenants of properties owned by Park Ventures SAL and coordinated with outside accountants to prepare tax documents for companies such as Park Ventures SAL and Blue Star Diamonds SAL—Offshore, a Lebanese company previously designated for its connection to Nazem Said Ahmad.

“Mohamad Ismail directs, owns, or controls several trading companies, including Lebanon-based Ismail General Trading; Lebanon-based Joud General Trading; Sofia, Bulgaria-based TIA Trading 2013 OOD; and Lebanon-based Associates of Partners SAL.

“Ali Mossalem also coordinated with Hind Ahmad regarding the creation of false invoices for pieces of artwork on behalf of Nazem Said Ahmad and conspired to draw up false invoices under the name of Rami Baker or United Investment Group SAL.

“Ali Osseiran, who directs three Dubai-based companies, Best Diamond House DMCC, G and S Diamond FZE, and Bexley Way General Trading LLC, facilitated the payment, shipment, and importation of works of art purchased by Nazem Said Ahmad from major auction houses and international galleries. Dubai-based company IDIAMS DMCC was involved in several of these art purchases. Maricel Francisco is an employee of Bexley Way General Trading LLC who has handled payments for art purchases through companies controlled by Ali Osseiran.

“Fadi Sader, a dual Canadian-South African national of Lebanese origin, has provided material support to Firas Ahmad. Fadi Sader directs, owns, or controls Hong Kong-based House of Art Limited, Hong Kong-based Fadico HK Limited, and South Africa-based Fadico S A CC. Mega Gems, a company directed and indirectly owned or controlled by Firas Ahmad, acted as a sister company with House of Art Limited to serve as the network’s conduit to clientele in Asia looking to purchase polished stones or finished jewelry, with Mega Gems serving as the intermediary to rough diamonds in Africa. Fadi Sader and his businesses also acted as a hub for art and luxury goods to be sold at or purchased from Hong Kong-based auction houses or other vendors in the Pacific, including acting as a courier for a work of art purchased on behalf of Nazem Said Ahmad, personally transporting the item from a Hong Kong auction house to Lebanon.

“Mohamad Wehbe, a Lebanese national and co-director of Mega Gems and sole director of Gavia Tradings (PTY) LTD, provided material support to Firas Ahmad by handling a variety of business operation functions for Firas Ahmad’s business ventures in South Africa. This included assisting Firas Ahmad in changing the ownership structure of South Africa-based Thula Uzwe, allowing Firas Ahmad to be the authorized representative for rough diamond purchases, with the hopes of expanding the company into new markets. Mohamad Wehbe was also a director of South Africa-based, real estate holding companies Oxfocento (PTY) LTD and Diotrix (PTY) LTD.

“Bassem Murad is a Belgian national who owns, controls, or directs Antwerp, Belgium-based M.S.D., South Africa-based MSD Capital (PTY) LTD, Dubai-based MSD DMCC, and South Africa-based MSD SPRL Diamond Trading. Both Bassem Murad and MSD SPRL Diamond Trading are involved in the business venture for the design, development, and construction of a new diamond center to house the offices and facilities for Mega Gems and other diamond businesses owned or directed by the directors of Oxfocento (PTY) LTD and Diotrix (PTY) LTD. Bassem Murad also conducted transactions or acted as a pass-through for funds in the interest of Firas Ahmad in a money laundering layering scheme.

“Hussein Nachar is a longtime associate of Nazem Said Ahmad, who operated with the total confidence of Nazem Said Ahmad while the 50 percent owner of DRC-based company, Primo-Gem Diamond, which was associated with money laundering, tax evasion, the blood diamond trade, and financial support to Hizballah. Between 2020 and 2021, Hussein Nachar and Ali Nachar engaged in transactions with Firas Ahmad, many of which were likely in cash and circular in nature, a practice which is known to be an indicator of money laundering.

“Fadi Abbas Saad conducted transactions for funds in the interest of Firas Ahmad in a money laundering layering scheme. Fadi Abbas Saad was also Firas Ahmad’s proxy director and shareholder of Oriental Dynasty Limited from 2015 to 2018, prior to Firas Ahmad’s wife Rim Nasser relieving him of this position.

“Additional Businesses

“Dubai-based diamond company Amana Diam DMCC was used as a pass-through business in a money laundering scheme on behalf of Rami Baker. Antwerp-based diamond company Helics Gemb BVBA acted as a broker for Amana Diam DMCC for sales of over $18 million in the first half of 2022 and was likely engaged in suspicious trades in diamonds.

“Individuals and Entities Designated Today

“Sundar Nagarajan, Ali Mossalem, Mohamad Hijazi, Firas Ahmad, Mohamad Ismail, Hind Ahmad, Rima Baker, Rami Baker, Ali Osseiran, Ibrahim Ghaddar, Mohamad Khawaja, White Star DMCC, Best Diamond House DMCC, Bexley Way General Trading, G&S Diamonds FZE, United Investment Group SAL, and Idiams DMCC are being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Nazem Said Ahmad.

“Rim Nasser, Fadi Sader, Mohamad Wehbe, Bassem Murad, Ali Nachar, Fadi Abbas Saad, Hussein Nachar, and Fadico HK Limited are being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Firas Ahmad.

“Amana Diam DMCC is being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Rami Baker.

“Daoud El Riz is being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Hind Ahmad.

“Maricel Francisco is being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Ali Osseiran.

“Helics Gemb BVBA is being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Amana Diam DMCC.

“Gavia Tradings (PTY) LTD and Oxfocento (PTY) LTD are being designated pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, directly or indirectly, Mohamad Wehbe.

“MSD SPRL Diamond Trading is being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Oxfocento (PTY) LTD.

“High Rise Property Investments (PTY) LTD is being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Oxfocento (PTY) and Diotrix (PTY) LTD.

“Mega Gems (PTY) LTD, Oriental Dynasty Limited, and Thula Uzwe Trading are being designated pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, directly or indirectly, Firas Ahmad.

“House of Art Limited is being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, Mega Gems (PTY) LTD.

“Artual Gallery and DIDA are being designated pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, directly or indirectly, Hind Ahmad.

“TIA Trading 2013 OOD, Associates of Partners SAL, Ismail General Trading, and Joud General Trading is being designated pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, directly or indirectly, Mohamad Ismail.

“Collecting Bee SRL, Debbiye 383 SAL, and 76 Benmore Garden Trust are being designated pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, directly or indirectly, Rami Baker.

“Park Ventures SAL is being designated for being owned, controlled, or directed by, directly or indirectly, Rima Baker.

“Diotrix (PTY) LTD, MSD Capital (PTY) LTD), MSD DMCC, and M.S.D. are being designated pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, directly or indirectly, Oxfocento (PTY) LTD.

“Fadico S A CC is being designated pursuant to E.O. 13224, as amended, for being owned, controlled, or directed by, directly or indirectly, Fadi Sader.

SANCTIONS IMPLICATIONS

“As a result of today’s action, unless otherwise authorized, all property and interests in property of these persons that are in or come within the United States or in the possession or control of U.S. persons must be blocked and reported to OFAC. In addition, any entities that are owned, directly or indirectly, 50 percent or more by one or more blocked persons are also blocked. OFAC regulations generally prohibit all dealings by U.S. persons or within the United States (including transactions transiting the United States) that involve any property or interests in property of designated or otherwise blocked persons.

“In addition, persons that engage in certain transactions with the persons designated today may themselves be exposed to sanctions or subject to an enforcement action. Furthermore, any foreign financial institution that knowingly facilitates a significant transaction or provides significant financial services for any of the targets designated today pursuant to E.O. 13224, as amended, could be subject to U.S. sanctions.

“The power and integrity of OFAC sanctions derive not only from OFAC’s ability to designate and add persons to the Specially Designated Nationals and Blocked Persons List (SDN List), but also from its willingness to remove persons from the SDN List consistent with the law. The ultimate goal of sanctions is not to punish but rather to bring about a positive change in behavior. For information concerning the process for seeking removal from an OFAC list, including the SDN List, please refer to OFAC’s Frequently Asked Question 897. For detailed information on the process to submit a request for removal from an OFAC sanctions list, please refer to OFAC’s website.

“View identifying information on the persons designated today.”

Justice Department

“A nine-count indictment was unsealed today in the Eastern District of New York charging Nazem Ahmad and eight co-defendants with conspiring to defraud the United States and foreign governments, evade U.S. sanctions and customs laws and conduct money laundering transactions by securing goods and services for the benefit of Ahmad, a Lebanese resident and dual Belgian-Lebanese citizen who was sanctioned by the United States for being a financier for Hezbollah, a foreign terrorist organization.

“A nine-count indictment was unsealed today in the Eastern District of New York charging Nazem Ahmad and eight co-defendants with conspiring to defraud the United States and foreign governments, evade U.S. sanctions and customs laws and conduct money laundering transactions by securing goods and services for the benefit of Ahmad, a Lebanese resident and dual Belgian-Lebanese citizen who was sanctioned by the United States for being a financier for Hezbollah, a foreign terrorist organization.

“According to court documents, despite being sanctioned and prohibited from engaging in transactions with U.S. persons since December 2019, Ahmad and his co-conspirators relied on a complex web of business entities to obtain valuable artwork from U.S. artists and art galleries and to secure U.S.-based diamond-grading services all while hiding Ahmad’s involvement in and benefit from these activities. Approximately $160 million worth of artwork and diamond-grading services were transacted through the U.S. financial system. One defendant was arrested today in the United Kingdom at the request of the United States, and the eight remaining defendants, including Ahmad, are believed to reside outside the United States and remain at large. The government obtained seizure warrants for millions of dollars in assets that include a diamond ring, cash in an account and artwork.

“'Despite being sanctioned for his dealings with a terrorist organization, Mr. Ahmad remained active in the U.S.-based art and diamond trade while concealing his illicit involvement,' said Assistant Attorney General Matthew G. Olsen of the Justice Department’s National Security Division. 'Today, we hold Ahmad and his associates accountable and demonstrate that those who would flout our sanctions cannot hide from U.S. justice.'

“'The United States implemented terrorism sanctions so that terrorist organizations like Hezbollah would be cut off from the goods and services needed to fund violent acts of terrorism,' said U.S. Attorney Breon Peace for the Eastern District of New York. 'As alleged, Nazem Ahmad and his co-defendants benefitted from the multimillion-dollar trade in diamonds and artwork even after Ahmad was sanctioned for his involvement with a terrorist organization. Our office will continue to prosecute individuals who evade these sanctions and thereby offer a lifeline to designated foreign terrorist organizations.'

“'Let this action against Nazem Ahmad’s international criminal organization serve as a reminder that the U.S. government and its allies will tirelessly prosecute those who are sanctioned for illicitly financing terrorist activities and wantonly violate those sanctions in order to continue accruing substantial wealth that can be used to continue financing Hezbollah,' said Deputy Secretary John K. Tien of Department of Homeland Security. 'We are grateful to our partners across the federal government and our partnership with the United Kingdom that demonstrates international commitment and cooperation to preventing future atrocities by dismantling illicit financial networks supporting terrorism.'

“'The funding of foreign terrorist organizations like Hezbollah is illegal, regardless of whether that funding comes in the form of cash or the export of high-priced diamonds and art,' said Assistant Secretary Export Enforcement Matthew S. Axelrod of the Department of Commerce. 'We are proud to have partnered with the Justice Department and HSI to bring this significant enforcement action.'

“As alleged, Ahmad was involved in real estate development, the international trade of diamonds, and the international acquisition and sale of artwork, and operated these enterprises through a complex web of business entities. Ahmad was also an associate of high-level members of Hezbollah, a Lebanon-based terrorist group that was designated by the United States as a Foreign Terrorist Organization and Specially Designated Global Terrorist. On Dec. 13, 2019, pursuant to the International Emergency Economic Powers Act (IEEPA) and the Global Terrorism Sanctions Regulations, the U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC) designated Ahmad and 11 businesses associated with Ahmad as Specially Designated Nationals (SDNs) for Ahmad’s material support of, and provision of goods and services to, Hezbollah. At the time of the designation, OFAC explained that Ahmad was “considered a major Hezbollah financial donor who laundered money through his companies for Hezbollah and provided funds personally to Hezbollah Secretary-General Hassan Nasrallah” and was also “involved in ‘blood diamond’ smuggling” who “stores some of his personal funds in high-value art.”

“Despite being sanctioned and prohibited from engaging in most transactions with U.S. persons, Ahmad continued to secure valuable goods and services from U.S. persons notwithstanding that such transactions constituted violations of U.S. sanctions and other federal laws. Specifically, Ahmad, together with his son Firas Michael Ahmad, daughter Hind Nazem Ahmad and brother-in-law Rami Yaacoub Baker, as well as associates Mohamad Hijazi, Mohamad Hassan Ismail, Sarya Nemat Martin, Ali Said Mossalem Sundar Nagarajan and others, used numerous corporate entities and individuals to disguise Ahmad’s control and beneficial interest in the companies and in financial transactions, and facilitate the acquisition of multiple pieces of valuable artwork and diamond-grading services for millions of dollars’ worth of diamonds from U.S. persons.

Evasion of Terrorism Sanctions in the Diamond Trade

“As alleged, the defendants conspired to violate and evade U.S. sanctions by obtaining grading determinations and other services from a U.S.-based diamond grading company (Diamond Grading Company-1). The services of Diamond Grading Company-1, which were secured through multiple entities operating for Ahmad’s benefit, were valuable to the defendants because the services provided can affect the sales price of those diamonds and thus increase the amount that Ahmad can receive for the sale of his property. Collectively, the defendants and other conspirators sent approximately 482 diamond submissions to Diamond Grading Company-1 facilities after Ahmad was designated by OFAC in December 2019. The total weight of the diamonds submitted and graded post-sanctions was approximately 1,546 carats. For example, on or about March 18, 2021, an entity operating for the benefit of Ahmad shipped an approximately 45-carat diamond – valued at $80 million – to a facility belonging to Diamond Grading Company-1 in New York. Following the receipt of services from Diamond Grading Company-1, the 45-carat diamond was exported from the United States on April 26, 2021, back to the same entity.

Evasion of Terrorism Sanctions in the Art Market

“The defendants also conspired to violate and evade U.S. sanctions by acquiring contemporary art from the United States, from U.S. persons outside the United States, or through U.S.-based financial transactions, on behalf of and for the benefit of Ahmad, despite his status as an OFAC-sanctioned SDN. Artwork allegedly obtained from the United States after Ahmad was sanctioned in December 2019 was valued at more than $450,000, while an additional $780,000 in artwork from U.S. persons located outside the United States was also acquired in violation of terrorism sanctions.

“For example, in or about and between April 2021 and July 2021, Ahmad and several other defendants engaged in multiple transactions with a Chicago-based art gallery (Chicago Art Gallery-1), on behalf of and for the benefit of Ahmad. Ahmad allegedly commissioned multiple pieces of artwork, at least one of which can be seen in a picture with Ahmad, as depicted below:

“Between approximately February 2021 and November 2021, Ahmad and two other defendants engaged in transactions with a New York-based artist (New York Artist-1), on behalf of and for the benefit of Ahmad. After Ahmad directly negotiated the sale of artwork from New York Artist-1 – pointedly directing the artist not to mention Ahmad’s name to anyone – six paintings valued at $199,800 were exported from the United States via John F. Kennedy International Airport to a Lebanese business entity used by Ahmad. At least one piece of artwork acquired from New York Artist-1 was hung in Ahmad’s residence in Lebanon.

“As part of this criminal scheme, the defendants also caused the undervaluation of goods in U.S. customs records in violation of federal law and took other steps to obscure the value of the goods they received in order to avoid the payment of foreign taxes when the goods were imported into the relevant country.

“The defendants and other conspirators engaged in this scheme to benefit Ahmad and themselves while at the same time evading terrorism-related sanctions, to avoid the payment of taxes to foreign governments on the import of valuable goods into foreign countries and to make it more difficult for the United States government to carry out its lawful functions. Entities controlled by or operating for the benefit of Ahmad engaged in more than $400 million worth of financial transactions between approximately January 2020 and August 2022; the conspirators were responsible for importing more than $207 million of goods to the United States and exporting more than $234 million of goods from the United States between approximately December 2019 and December 2022, consisting primarily of diamonds and artwork; and approximately $160 million worth of transactions involved the U.S. financial system. At least $6 million of the proceeds of the criminal scheme was transferred to Lebanon for use by Ahmad and his associates.

“Assistant U.S. Attorneys Craig R. Heeren and Nicholas J. Moscow for the Eastern District of New York and Trial Attorney Scott A. Claffee of the National Security Division’s Counterintelligence and Export Control Section are in charge of the prosecution, with assistance from Paralegal Specialists Benjamin Richmond and Magdalena St. Surin. Assistant U.S. Attorney Claire Kedeshian of the is handling asset forfeiture. The Department of Justice Office of International Affairs is assisting with extradition and international legal assistance in this case.

“This investigation was a collaboration between HSI Cedar Rapids, New York, HSI New York Counter Proliferation Investigations and Trade Transparency Unit which was made possible through support from HSI Chicago, Dallas, Houston, Kansas City, Los Angeles, Raleigh, St. Paul, and Santa Rosa. HSI Attaché offices in Africa, Asia, Europe, and the Middle East played critical roles in the investigation. U.S. Customs and Border Protection was also a key investigative partner.

“The Department also appreciates the significant cooperation and assistance provided by the United Kingdom authorities.”

Britain

“The UK Government has announced a full asset freeze against an individual suspected of financing the terrorist group Hizballah.

“The UK Government has announced a full asset freeze against an individual suspected of financing the terrorist group Hizballah.

“Nazem Ahmad has been sanctioned as part of continued efforts to prevent terrorism in the interests of national security. The move will also protect the integrity of the UK economy from terrorist financing threats.

“All assets and economic resources belonging to Ahmad in the UK have been frozen and no UK person may do business with him or any of the companies he owns or controls.

“This is the first use of the Treasury-led domestic counter terrorism regime, which is used to target those who HM Treasury has reasonable grounds to suspect are involved in terrorist activity.

“Treasury Lords Minister Baroness Penn said:

“'We will always proactively defend our economy against those who seek to abuse it.

“'The firm action we have taken today will clamp down on those who are funding international terrorism, strengthening the UK’s economic and national security.'

“The action is part of a coordinated effort with partners to disrupt an international terrorist-financing operation.

“Ahmad has an extensive art collection in the UK and he conducts business with multiple UK-based artists, art galleries and auction houses. Following his designation he will be prevented from trading in the UK art market, and other dealers in high-value items will no longer be able to conduct business with him and his associated companies including White Starr DMCC, Bexley Way General Trading LLC, Best Diamond House DMCC, Sierra Gem Diamonds Company NV, Park Ventures SAL and the Artual Gallery.

Further information

- “This is first time use of powers to designate an individual under the Counter Terrorism (Sanctions) (EU Exit) Regulations 2019.

- “An asset freeze means that it is generally prohibited to deal with the funds or economic resources which are owned, held or controlled by a designated person. The freeze prohibits the making available of further funds or economic resources directly or indirectly to a designated person, and engagement in actions that directly or indirectly circumvent the prohibitions.

- “When an asset freeze is applied, the funds or economic resources are frozen immediately by the person in possession or control of them.

- “Imposing an asset freeze does not change the ownership of the frozen funds or economic resource and nor are they transferred to the Office of Financial Sanctions Implementation or HM Treasury for safekeeping.

Sanctioned individual

“Nazem Ahmad, suspected Hizballah financier who has control over White Starr DMCC, Bexley Way General Trading LLC, Best Diamond House DMCC, Sierra Gem Diamonds Company NV, Park Ventures SAL and the Artual Gallery.”

Picture Credits: Map via Treasury Department